UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2001

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-29889

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

94-3248524 (IRS Employer Identification Number) |

|

240 East Grand Avenue South San Francisco, California (Address of principal executive offices) |

94080 (Zip Code) |

(650) 624-1100

(Registrant's telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

The approximate aggregate market value of the Common Stock held by non-affiliates of the registrant, based upon the closing price of the Common Stock as reported on the Nasdaq National Market on March 15, 2002, was $101,033,428.

As of March 15, 2002, there were 45,298,663 shares of the registrant's Common Stock outstanding.

Documents Incorporated by Reference

Certain exhibits filed with the Registrant's prior registration statements and periodic reports under the Securities Exchange Act of 1934 are incorporated herein by reference into Part IV of this Report.

| |

|

Page |

||

|---|---|---|---|---|

| PART I | ||||

| Item 1. | Business | 2 | ||

| Item 2. | Properties | 29 | ||

| Item 3. | Legal Proceedings | 30 | ||

| Item 4. | Submission of Matters to a Vote of Security Holders | 30 | ||

PART II |

||||

| Item 5. | Market for the Registrant's Common Equity and Related Stockholder Matters | 31 | ||

| Item 6. | Selected Financial Data | 32 | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 40 | ||

| Item 8. | Financial Statements and Supplementary Data | 41 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 58 | ||

PART III |

||||

| Item 10. | Directors and Executive Officers of the Registrant | 59 | ||

| Item 11. | Executive Compensation | 62 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 64 | ||

| Item 13. | Certain Relationships and Related Transactions | 66 | ||

PART IV |

||||

| Item 14. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 68 | ||

| Signatures | 70 |

1

Overview

Statements made in this document other than statements of historical fact, including statements about Rigel's scientific programs, preclinical studies, product pipeline, corporate partnerships, licenses and intellectual property, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are subject to a number of uncertainties that could cause actual results to differ materially from the statements made, including risks associated with the success of research and product development programs, results achieved in future preclinical studies and clinical trials, the regulatory approval process, competitive technologies and products, the scope and validity of patents, proprietary technology and corporate partnerships. Reference is made to discussion about risks associated with product development programs, intellectual property and other risks that may affect our business under "Risk Factors" below. We do not undertake any obligation to update forward-looking statements.

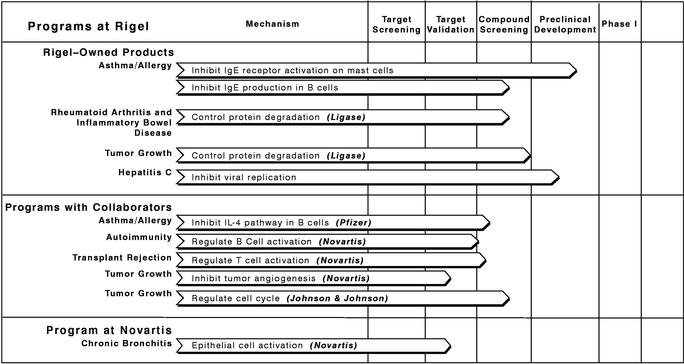

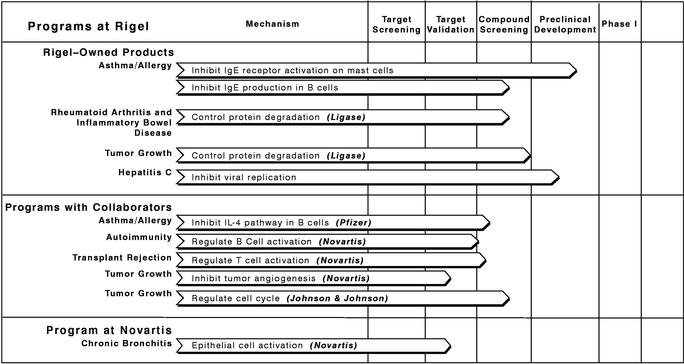

Rigel Pharmaceuticals, Inc. is a drug discovery and development company that uses advanced functional genomics tools to discover novel drug targets that can be used to develop orally administered small molecule drugs. Our technology is designed to identify molecules that play an important role in regulating a human cell's response to disease by testing a very large number of proteins in a very large number of cells to determine which proteins will change a cell's response to the disease. We currently have ten product development programs underway at Rigel, with five programs being proprietary programs in the product development areas of asthma/allergy, rheumatoid arthritis and inflammatory bowel disease, cancerous tumor growth and hepatitis C. We expect to begin clinical trials during 2002 with one or more drug candidates from these five programs. In addition to the Rigel-owned programs, we have five programs in connection with our corporate partners in the product development areas of asthma/allergy, autoimmunity, transplant rejection and two programs in cancerous tumor growth. With our support, one of our partners is conducting an additional program in chronic bronchitis at its premises. Rigel has multi-year collaborations with Pfizer Inc., Cell Genesys, Inc., Johnson & Johnson Pharmaceutical Research & Development, L.L.C. and Novartis Pharma A.G. Rigel is based in South San Francisco, California.

Our Strategy

Our strategy is to develop a large portfolio of drug candidates that may be developed into small molecule therapeutics. We believe that producing a portfolio of many drug candidates and working in conjunction with pharmaceutical companies to further develop those candidates greatly increase our probability of commercial success. By utilizing our technology to rapidly discover and validate new targets and drug candidates in a wide range of applications, we believe that our portfolio approach allows us to minimize the risk of failure by pursuing many drugs at once, while concurrently being well positioned to help fill a continuing product pipeline gap of major pharmaceutical companies.

The drug development process is one that is subject to both high costs and high risk of failures. Rather than incur the costs of taking drugs all the way through the drug approval process and exposing ourselves to the risk of failure associated with Phase III clinical trials, we intend to identify a portfolio of new drug compounds across a broad range of diseases and develop them through Phase II clinical trials only. We believe that approximately five drugs can be developed through Phase II clinical trials for approximately the same cost as would be required to take one drug through Phase III clinical trials and marketing approval.

2

The key elements of our scientific and business strategy are to:

3

Product Development

The following table summarizes key information in the 11 programs being conducted by Rigel and its partners that focus on specific disease mechanisms:

4

Immune Disorders

Many diseases and disorders result from defects in the immune system. Over 40 million people in the United States suffered from allergic disorders and over 20 million from asthmatic disorders in 2001. Anti-asthmatic and allergy relief medications exceeded $5 billion in worldwide sales in 2001. In 2001, another 3 million to 5 million patients in the United States were treated for other immune disorders. We currently have seven programs in immunology focused on asthma/allergy (three programs), autoimmunity, transplant rejection, rheumatoid arthritis/inflammatory bowel disease and chronic bronchitis.

Asthma/Allergy

Rigel-Owned Asthma/Allergy Programs

Inhibit IgE receptor activation on mast cells. The goal of this program is to identify compounds that inhibit the secretion of inflammatory factors resulting from IgE binding to its receptor on mast cells. Currently, we have identified several candidate compound series for development. Preliminary studies demonstrate that these compounds inhibit the ability of IgE to activate its receptor on mast cells. There is evidence in animal models and early clinical studies that blocking IgE mediated activation of mast cells can reduce allergic symptoms in multiple species, including humans. However, the only IgE programs in development today are intravenous therapeutic antibodies. We believe that small molecule inhibitors of IgE signaling pathways could play an important role in the treatment of such chronic disorders. We expect to file an investigational new drug, or IND, application with the United States Food and Drug Administration, or FDA, in 2002 for the compound currently in the most advanced stage of preclinical development.

Inhibit IgE production in B cells. In this program, we are evaluating a compound that appears to prevent the production and secretion of IgE in B Cells. This compound regulates a key event in the IL-4 pathway preventing the production of IgE.

Asthma/Allergy Program with Pfizer

Inhibit IL-4 production in B Cells. In this program with Pfizer that began in 1999, we have been seeking to identify and validate intracellular drug targets that control and inhibit the production of IgE in B Cells. The program has generated several targets that have been accepted by Pfizer, and these targets are now entering the drug discovery phase of the collaboration at Pfizer.

Autoimmunity/Transplant Rejection

Autoimmunity disorders and organ transplant rejection are the result of inappropriate activation of the immune system. Most existing therapies for inflammatory diseases also have toxic side effects. A challenge facing all research groups in this field has been the design of selective and specific immune system therapeutics that affect only the pathological activities without negatively affecting the protective activities of the immune system.

Our programs are designed to identify and validate novel molecules that specifically signal cell activation and cell death, or apoptosis, of T cells and B cells. Activation and apoptosis determine the quality, magnitude and duration of immune responses. Activation pathways are initiated by the binding of antigen (foreign protein) to specific surface receptors on T cells or B cells. This sets off an intracellular cascade of signals, resulting in changes in gene expression and the production of proteins that drive the immune response or lead to antibody production and secretion in B cells. The apoptosis signals prevent self activation, overactivation or prolonged activation of the T and B cells, which can lead to auto-immune disease or organ rejection. We are identifying T cell- and B cell-specific drug targets that are effective in modulating immune-mediated processes.

5

Autoimmunity/Transplant Rejection Programs with Novartis

Regulate B cell activation. The goal of the B cell activation program is to prevent antibody secretion by activated B cells, an important mechanism in autoimmunity transplantation rejection. We have identified novel drug targets using our post-genomics combinatorial biology technology. This program has been partnered with Novartis since August 1999.

Regulate T cell activation. The goal of our T cell activation program is to identify early steps in the process of T cell activation. T cells are responsible for cell-mediated inflammatory and humoral responses, both of which are important mechanisms of transplant rejection and autoimmune diseases. We have identified novel drug targets in this program that have been partnered with Novartis since May 1999.

Rheumatoid Arthritis/Inflammatory Bowel Disease

Rigel-Owned Rheumatoid Arthritis/Inflammatory Bowel Disease Program

Control protein degradation (ligase). This program is focused on characterizing and developing specific inhibitors of protein-degrading enzymes referred to as ubiquitin ligases. Many intracellular proteins that play a critical role in signaling pathways are regulated by this protein-degrading process. Many signaling proteins control cell function through active intermediates whose levels vary rapidly during different phases of a physiologic response. Disease processes can be treated by up-regulating or down-regulating these key signaling proteins as a way to enhance or dampen specific cellular responses. This principle has been successfully used in the design of a number of therapeutics for the treatment of inflammation. We have screened our library of small molecules against several members of the ubiquitin ligase family, and have identified several small molecule compounds which, based on preliminary data, appear to be potent and specific inhibitors.

Chronic Bronchitis

Chronic Bronchitis Program with Novartis

Epithelial cell activation. Using Rigel's technology, Novartis is pursuing a program for which the goal is to inhibit epithelial cell activation for the possible treatment of chronic bronchitis. This program is in the target screening and validation stage. Chronic bronchitis is a condition characterized by excessive mucus production that causes cough. It is associated with hyperplasia and hypertrophy of the mucus-producing glands found in the submucosa of large cartilaginous airways. Chronic bronchitis affects an estimated 5% of the U.S. population.

Cancer (Tumor Growth)

Cancer is a group of diseases characterized by the uncontrolled growth and proliferation of cells. This growth invades vital organs and often results in death. The United States market for branded cancer drugs totaled approximately $7.0 billion in 2001 and is projected to grow at an 11% annual growth rate. Cancer is the second leading cause of death in the United States, exceeded only by cardiovascular disease. In 2001, an estimated 1.3 million people were diagnosed with cancer, and more than 550,000 patients died of cancer in the United States. Although there have been improvements in cancer therapies over the last decade, there remains a significant medical need for the development of both more effective and less toxic drugs for these diseases.

Rigel-Owned Cancer Program

Control protein degradation. This antitumor program is focused on the ubiquitin ligase pathway unique to malignancies. The goal of this program is to use specific inhibitors of ubiquitin ligases that regulate mitosis, or cell division, to stop growth and induce aptosis in transformed cancer cell lines. We

6

completed high-throughput screening and have identified several preclinical candidate compounds in this program.

Cancer Programs with Collaborators

Regulate cell cycle (Johnson & Johnson). This program is directed at finding new targets that regulate the cell cycle and the cell cycle checkpoint pathways. The proliferation of normal cells is controlled by built-in safety mechanisms in the cell cycle, termed checkpoints, that ensure that only cells with normal genetic material can progress through the cell cycle and divide. Cells with genetic mutations are recognized and shunted into the apoptosis pathway to protect the organism from cancer and other genetic disorders. It is estimated that more than 50% of all human tumors contain cancer cells that have lost one or more crucial checkpoint genes. Cancer cells also can carry mutations in another group of normal cell genes that mimic extracellular proliferation signals, causing tumor cells to continue to divide even in the absence of normal cell growth signals. The net result of these genetic mutations is uncontrolled cell division and disease. We have collaborated with our partner since December 1998 to identify intracellular drug targets involved in cell cycle control. We have identified several novel drug targets in this program, two of which have been accepted by Johnson & Johnson as validated. These targets have completed high-throughput screening at Rigel and compounds have been identified that are in the lead profiling stage.

Inhibit tumor angiogenesis (Novartis). This antitumor program is directed toward the angiogenesis pathway. Angiogenesis is defined as the growth of new blood vessels. In diseased circumstances or in oxygen deficient conditions, angiogenesis is stimulated by the synthesis and release of specific pro-angiogenic factors. In contrast to normal angiogenesis, tumor angiogenesis is a continuous process. As a significant proportion of tumors are dependent on continued angiogenesis, inhibition of this process blocks tumor growth which often leads to complete tumor deterioration. Thus, we believe therapeutic intervention of tumor-promoted angiogenesis represents an important form of antitumor therapy. We have established and initiated two screens in human capillary endothelial cells using our post-genomics combinatorial biology technology and have identified several potential targets in the angiogenesis pathway. This drug discovery program for finding new targets for the development of small molecule inhibitors has been ongoing for approximately two years, and our collaboration with Novartis was initiated in July 2001.

Hepatitis C (Infectious Diseases)

Rigel-Owned Hepatitis C Program

Inhibit viral replication. We have initiated a viral research program based upon technology acquired from Questcor in September 2000. Hepatitis C is a major cause of chronic hepatitis, cirrhosis and hepatocellular carcinoma. The goal of this program is to interfere with the IRES translation and replication mechanism of the hepatitis C virus. We are attempting to discover and develop a highly specific inhibitor of the viral replicon in the form of a small molecule compound. A set of high-throughput cell-based screens has been established and initial compounds have been identified as part of this program. These compounds are currently being evaluated in preclinical studies as candidates for development.

Under the terms of our agreement with Questcor, we are obligated to assign back to Questcor all of our rights in the technology and intellectual property to which we are entitled pursuant to the agreement if we commit a material breach of the agreement and if Questcor follows certain procedures set forth in the agreement.

7

Ligase Initiative

The goal of the Ligase Initiative is to identify and determine the function of all ubiquitin ligases and ubiquitin proteases. These ligases and proteases are a very large family of enzymes that regulate the destruction of specific proteins in cells. Inappropriate activity of these enzymes has been implicated in cancer and autoimmunity, metabolic, cardiovascular and neurodegenerative diseases. It is believed that disease processes may be treated by either up-regulating or down-regulating these key signaling enzymes as a means of developing multiple therapeutic solutions.

Background

We were incorporated in the State of Delaware on June 14, 1996. We matured from a development stage to an operating company in 1998. We have funded our operations primarily through the sale of private and public equity securities, payments from corporate collaborators and capital asset lease financings. We have no subsidiaries.

Pharmaceutical Industry Need for New Drugs and Novel Targets

In order to sustain growth, each major pharmaceutical company needs to bring approximately two or more new drugs to market each year. However, it is currently estimated that, using traditional drug discovery and development methodologies, each major pharmaceutical company is bringing to market, on average, less than one new drug per year. As a result, major pharmaceutical companies have a discovery and product pipeline gap. In addition, we believe this demand for new products will be increased by the expiration in coming years of patents on numerous significant revenue-generating drugs. Increasingly, pharmaceutical companies are turning to biotechnology companies to supplement their own research in the efforts to fill their product pipelines and are willing to pay higher prices for those products.

We believe that several thousand of the approximately 30,000 genes in the human genome will provide potential drug targets directed at specific diseases. Despite this potential, researchers have only identified and validated approximately 500 distinct targets for existing drug interventions that serve as the basis for many pharmaceutical products today. We feel that the existing, relatively small, pool of potential targets limits pharmaceutical companies' opportunities to develop new drug candidates to satisfy their growth objectives. Moreover, we believe this situation creates a critical need for tools directed at novel ways to expand the pool of targets by rapidly identifying and successfully validating new targets that lead to new chemical entities.

Traditional Drug Discovery

The traditional drug discovery process involves testing or screening compounds in disease models. The process is often undertaken with little knowledge of the intracellular processes underlying the disease or the specific drug target within the cell. Consequently, it is necessary to screen a very large number of arbitrarily-selected compounds in order to obtain a desired change in a disease model. While this approach sometimes successfully produces drugs, it has a number of disadvantages:

8

Subsequent Biological Advances and Genomics

Beginning in the mid 1970s, pharmaceutical companies began to use a growing knowledge of cellular and molecular biology to enlarge their understanding of biochemical interactions within and between cells in order to understand the cellular basis for disease processes. For example, researchers equipped with a more thorough understanding of cellular mechanisms relating to blood pressure regulation were able to identify proteins called angiotensin converting enzymes (ACE) that regulate molecules causing high blood pressure. By identifying compounds that act as ACE inhibitors, the researchers developed a family of highly specific drugs that lower blood pressure without causing serious side effects.

More recently, pharmaceutical companies have begun to identify specific genes involved in disease. For example, the Human Genome Project was undertaken to identify the DNA sequence of all the genes in the human genome, with the hope that knowledge of the human genome would enable a comprehensive understanding of the molecular causes of all diseases, and therefore provide a source of targets for drug discovery. However, merely developing sequence data with respect to genes does not, on its own, provide information about the cellular function of the proteins encoded by the genes expressed in a particular tissue at a particular time under particular disease circumstances. In addition, it fails to tell us which proteins might make useful targets for compound screening to identify drug candidates to modulate any of these functions. With approximately 30,000 genes in the human genome, the number of possible combinations of expressed proteins in a cell and the number of possible interactions of those proteins produce a volume of information that often obscures rather than illuminates the functional role of any particular gene in a disease process.

Later efforts to link genes to disease, or functional genomics, have focused on the genes that are responsible for changes in the behavior of cells under disease conditions. However, the functional connection between particular genes and their expressed proteins on the one hand, and cellular behavior seen in disease conditions on the other hand, has remained unknown in the majority of diseases. For this reason, pharmaceutical companies have sought better means to identify the genes that are important to cellular behavior and to understand their role in causing or preventing disease. Whether through gene sequencing or functional genomics, understanding the functional role of a gene is critical to understanding, identifying and validating a gene's expressed protein as a target for compound screening. We believe that there remains a critical need for research methods that will be able to utilize the information currently available to identify protein targets quickly and systematically, with increased probability of discovering new drug candidates.

Role of Target Validation

The identification of intracellular protein targets is an important step in the process of identifying potential drugs. Most drugs are discovered today by screening collections of libraries of chemical compounds against protein targets that are part of signaling, or information-transmitting, pathways within cells. These signaling pathways participate in the regulation of cell behavior in both normal and diseased cells. However, drug discovery and development often occurs without first validating the drug target and mechanism of action. If pharmaceutical companies were to validate a target's role in a disease at an early stage, they would reduce risks involved in the drug development process, such as the pursuit of unsuccessful discovery pathways, regulatory delay and mechanism-based side effects.

A target is regarded as validated if a causal link is established between an intracellular protein target and a cellular response important in a disease process. Each drug discovery company has its own standards for deciding whether a target has been sufficiently validated.

9

Our drug target discovery process bypasses the need to know the identity or sequence of the genes. We have developed two core technologies that we believe provide us with an enhanced ability to simultaneously identify and initially validate new drug targets for further development.

Our technologies are designed to identify protein targets for compound screening and validate the role of those targets in the disease process. Unlike genomics-based approaches, which begin by identifying genes and then search for their functions, our approach identifies proteins that are demonstrated to have an important role in a disease pathway. By understanding the disease pathway, we attempt to avoid studying genes that will not make good drug targets and focus only on the sub-set of expressed proteins of genes that we believe are specifically implicated in the disease process.

We begin by developing assays that model the key events in a disease process at the cellular level. We then efficiently search hundreds of millions of cells to identify potential protein targets. In addition, we identify the proteins involved in the intracellular process and prepare a map of their interactions, thus giving us a comprehensive picture of the intracellular disease pathway. We believe that our approach has a number of advantages:

Because of the very large number of cells and proteins employed, our technology is labor intensive. The complexity of our technology requires a high degree of skill and diligence to perform successfully. In addition, successful application of our technology depends on a highly diverse collection of proteins to test in cells. We believe we have been able to and will continue to meet these challenges successfully. Although one or more other companies may utilize technologies similar to certain aspects of our technology, we are unaware of any other company that employs the same combination of technologies as we do.

Technology

Our retroviral and pathway mapping technologies enable us to identify and validate new protein targets and establish a map of the intracellular proteins that define a specific signaling pathway controlling cellular responses. We believe that, together, these technologies allow for rapid pathway mapping of complex biological processes and increase our ability to identify targets for drug discovery.

Retroviral Functional Screening. Our retroviral technology introduces up to 100 million different peptides, or proteins, into an equal number of normal or diseased cells. Each retrovirus delivers a

10

specific gene into an individual cell, causing the cell to produce a specific protein. Then, we stimulate the cells in a manner known to produce a disease-like behavioral response or phenotype of the disease process. Once in the cell, the expressed protein interacts with potential protein targets in the cell. Then, we sort the cells at a rate of up to 60,000 cells/second to collect data on up to five different parameters, which means that a sort of 100 million cells can be completed in approximately half an hour. By analyzing the approximately 500 million resulting data points, we can rapidly identify those few cells containing an expressed protein that has interacted with a protein target in a way that causes the cell to change its behavior from diseased back to normal. Using this method, we believe that we can identify the relatively few targets that are validated in the context of a disease-specific cellular response.

Pathway Mapping. Our pathway mapping technology identifies specific proteins that bind with other proteins that are known to be part of a signaling pathway, either because we identified them using our retroviral technology or because the proteins have been described in the scientific literature. This pathway mapping technology is directed at:

Using our pathway mapping technology, we split a protein that gives a detectable signal (reporter protein), such as fluorescence, into two inactive parts. One part of the reporter protein is fused with a specific protein known to be involved in a signaling disease-relevant pathway (bait protein). Multiple copies of the other part of the reporter protein are fused one by one with all the proteins known to be present in the cell type being studied (library protein). When the bait protein binds to a specific library protein, the two parts of the reporter protein reunite and become active again, thereby generating a detectable signal. We employ an improved version of the two hybrid protein interaction method in yeast cells. In addition, we have developed a patented method of employing the two hybrid protein interaction technology in mammalian cells. Mammalian cells offer the opportunity to monitor protein-protein interactions in a potentially more relevant cellular environment.

Our proteomics program is an integral part of our target discovery and validation effort. In contrast to our retroviral and pathway mapping technologies, which can be used to find single protein-protein interactions, proteomics techniques can be used to find protein complexes comprised of several protein targets and to study protein-protein interactions in order to map active interaction sites on potential protein targets. To this end, we believe our protein chemistry group uses the most advanced proteomic technologies, including high resolution two dimensional gel electrophoresis in conjunction with in-gel tryptic digests followed by mass spectrometry, in order to identify specific drug targets.

We also use this pathway mapping technology to screen identified protein targets against a library of peptides in order to identify each active interaction site on the target. This information is useful in directing our chemistry efforts to identify compounds specifically designed to bind to the interaction site on the target.

Target Validation

The first step of our target validation occurs when we use our retroviral technology to identify targets. We design a screen that reflects a key event in a disease process so that when one of our proteins changes the behavior of a specific cell, this indicates a causal relationship between the protein-target interaction and the specific disease response. This approach saves time and enhances the probability that those targets that are identified and pursued are disease relevant. It also tells us that

11

the protein interacts with a functional site on the target since the interaction results in a change in the behavior of the cell. We further validate the function of specific targets by:

Other Technologies

Our drug discovery technologies utilize the following additional technologies:

High-Throughput Compound Screening

Using our cell sorter system, we conduct screening of small molecule compounds in the same cell-based disease-specific screens that we use to identify the protein targets. This enables us to screen thousands of compounds in a matter of a few hours, while simultaneously examining multiple physiological parameters. In addition, we have established conventional high-throughput screens of small molecule compounds using biochemical methods similar to those widely used in the biotechnology and pharmaceutical industries. We have a library of approximately 210,000 synthetic small molecule compounds having highly diverse molecular structures for our compound screening activities.

We select for compound screening only those protein drug targets we judge to meet several criteria:

Medicinal and Combinatorial Chemistries

Our medicinal chemistry group carries out traditional structure-activity relationship studies of potential lead compounds and makes improvements to those compounds by utilizing chemistry techniques to synthesize new analogs of a lead compound with improved properties. Our chemistry group synthesizes compounds incorporating desirable molecular features. We also utilize outside contract research organizations such as Albany Molecular Research, Emerald Biostructures and Evotec OAI to supplement our internal chemistry resources.

Pharmacology and Pre-clinical Development

We believe that the rapid characterization and optimization of lead compounds identified in high-throughput screening will generate high-quality pre-clinical development candidates. Our pharmacology and pre-clinical development group facilitates lead optimization by characterizing lead compounds with respect to pharmacokinetics, potency, efficacy and selectivity. The generation of proof-of-principle data in animals and the establishment of standard pharmacological models with which to assess lead compounds represent integral components of lead optimization. As programs move through the lead optimization stage, our pharmacology and pre-clinical development group supports

12

our chemists and biologists by performing the necessary studies, including toxicology, for IND application submissions.

Clinical Development

We have assembled a team of experts in drug development to design and implement clinical trials and to analyze the data derived from these studies. The clinical development group possesses expertise in project management and regulatory affairs.

Research and Development Expenses

Our research and development expenses were $32.3 million in 2001, $32.0 million in 2000 and $17.1 million in 1999.

Corporate Collaborations

To fund a wide array of research and development programs, we have established and will continue to pursue corporate collaborations with pharmaceutical and biotechnology companies. We currently have collaborations on five of our ten research programs, including one with Johnson & Johnson relating to oncology therapeutics and diagnostics, one with Pfizer relating to asthma and allergy therapeutics, and three programs with Novartis relating to immunology and oncology. Novartis is conducting an additional program in chronic bronchitis with our support.

As of December 31, 2001, we had received a total of $62.1 million from our collaborators. Included in this amount is $20.0 million from the sale of both private and public equity securities and $42.1 million from the receipt of technology access fees, research funding and milestone payments, of which $5.5 million had been deferred at December 31, 2001. In addition, we have a number of scientific collaborations with academic institutions and biotechnology companies under which we have in-licensed technology. We intend to pursue further collaborations as appropriate.

In most of our collaborations, inventions are intended to be owned by the employer of the inventor or inventors thereof in accordance with United States patent law, subject to licenses or assignments granted in the agreements.

Johnson & Johnson

Effective December 1998, we entered into a three-year research collaboration, ending on December 4, 2001, with Janssen Pharmaceutica N.V., a division of Johnson & Johnson, to identify, discover and validate novel drug targets that regulate cell cycle, and, specifically, to identify drug targets and the active peptides that bind to them that can restore a mutated cell's ability to stop uncontrolled cell division. In December 2001, Johnson & Johnson extended this research collaboration for an additional two years. Under the agreement, we will provide certain assays and associated technology to Johnson & Johnson for the assessment of the alteration or normalization of the dysfunctional cell cycles of cancer cells for Johnson & Johnson's internal research purposes. Furthermore, in an amendment to the collaboration in July 2000, Johnson & Johnson expanded the collaboration whereby we are also now performing compound screening and medicinal chemistry on validated targets accepted by Johnson & Johnson. Through January 2002, Johnson & Johnson had accepted two validated targets, both of which have undergone high-throughput screening.

Under the collaboration, Johnson & Johnson has the exclusive right to utilize our technology, and technology developed during the collaboration, to discover, develop, identify, make and commercialize certain products on a worldwide basis. These products are:

13

collaboration or identified in a Johnson & Johnson screening assay as a result of Johnson & Johnson's internal research;

Johnson & Johnson also has a non-exclusive right to use our technology, and technology developed during the research collaboration, to the extent necessary to use the assays we transfer to Johnson & Johnson for internal research. Johnson & Johnson's rights are subject to its obligation to provide research funding for the collaboration, make milestone payments and technology access payments to us and pay royalties to us on the sales of products.

We will have the non-exclusive right to use any technology developed by Johnson & Johnson during the research collaboration, and any improvements to our technology developed by Johnson & Johnson during its internal research, on a royalty-free and worldwide basis.

The Johnson & Johnson Development Corporation purchased 1,500,000 shares of our Series D preferred stock at a price per share of $2.00 in connection with our Series D financing and purchased 166,666 shares of our Series E preferred stock at a price per share of $6.00 in connection with our Series E financing. The 1,666,666 shares of preferred stock converted into 1,666,666 shares of common stock upon completion of our initial public offering in December 2000.

Pfizer

Effective January 1999, we entered into a research collaboration with Pfizer, with the research phase of the collaboration scheduled to end on January 31, 2001. In January 2001, Pfizer notified us of its election to exercise its option to extend the funded research portion of the collaboration one additional year to January 31, 2002. During the research phase at Rigel, the collaboration was successful in identifying several intracellular drug targets that control the production of IgE, a key mediator in allergic reactions and asthma in B cells. Through the conclusion of the research phase of the collaboration in January 2002, Pfizer accepted a number of validated targets. We believe that Pfizer has plans to move the validated targets forward through its drug discovery process. We have provided the following technology developed or identified during and pursuant to the research portion of the collaboration with Pfizer:

Pfizer will exclusively own drug targets for which it has initiated HTS. We will have no obligation to Pfizer with regard to any drug target Pfizer does not select for HTS.

We and Pfizer each have the non-exclusive right to use for research purposes the technology of the other which was disclosed or developed during the research collaboration, excluding our peptide libraries and proprietary cell lines. Under the collaboration, Pfizer also has the exclusive, worldwide

14

right to develop and market diagnostic and therapeutic products for humans and animals that were identified by Pfizer in HTS and modulate the activity of a drug target identified in the research collaboration. Pfizer's rights to develop and market such products are subject to its obligation to continue to pay research milestones and pay subsequent royalties on the sales of these products.

Pfizer purchased 1,000,000 shares of Series D preferred stock at a price per share of $2.00 in connection with our Series D financing, which converted into 1,000,000 shares of our common stock upon completion of our initial public offering in December 2000.

Novartis

In May 1999, we signed an agreement for the establishment of a broad collaboration with Novartis, whereby the two companies agreed to work on up to five different five-year research projects to identify drug targets for products that can treat, prevent or diagnose the effects of human disease. Two of the research projects would be conducted jointly by Novartis and us, and the other three research projects were to be conducted at Novartis. The first research project, a joint research project, is focused on identifying small molecule drug targets that regulate T cells. The second research project, also a joint research project, relates to the identification and validation of small molecule drug targets that can mediate specific functions of B cells. The third research project, a project carried out at Novartis, is focused on identifying small molecule drug targets that regulate chronic bronchitis. In July 2001, Novartis and Rigel amended the agreement to add a three-year joint project at Rigel in the area of angiogenesis in lieu of a project at Novartis. This resulted in both funded research at Rigel and an additional upfront payment of $4.0 million, which were terms not previously included in the project at Novartis. In January 2002, Novartis chose not to exercise its option to add a second project to be conducted at Novartis.

Once a drug target from any of the four research projects has been identified and validated, Novartis shall have the right to conduct compound screening on such drug target on an exclusive basis for two years thereafter. Novartis will have the option to extend this exclusive right for up to five additional one-year periods so long as Novartis pays us an annual fee for such right and satisfies certain diligence conditions. Upon the expiration or termination of this right, both we and Novartis shall have the non-exclusive right to use, and allow others to use, such drug target for compound screening.

Under the agreement, Novartis has the non-exclusive right to utilize our retroviral technology and pathway mapping technology for confirmational and similar uses relating to validated drug targets, including uses necessary for the further development, registration and commercialization of products for which the principal mechanism of action is based upon, derived or discovered from, or discovered with the use of, a drug target. Novartis also has the exclusive right to utilize other of our technology, and technology developed during the collaboration, to make and commercialize these products. Novartis' rights are subject to its obligation to provide research funding for the joint research projects, pay milestone payments and technology access payments to us and pay third-party royalties associated with Novartis' use of certain of our technology.

Under the agreement, we will have the non-exclusive right to use any improvements to our retroviral technology and pathway mapping technology developed during a research project on a royalty-free and worldwide basis.

Novartis may terminate the initial joint research projects three and one half years after the applicable commencement date if Novartis gives six months prior notice of its termination. Novartis may terminate the research project to be conducted at Novartis at any time.

Novartis purchased 2,000,000 shares of our Series D preferred stock at a per share purchase price of $2.00 in connection with our Series D financing and purchased 1,428,571 shares of our common stock in a private placement concurrent with the closing of our initial public offering at a price of $7.00

15

per share. The 2,000,000 shares of preferred stock converted into 2,000,000 shares of our common stock in conjunction with our initial public offering in December 2000.

Cell Genesys

In September 1999, we established a research collaboration and license agreement with Cell Genesys. The goal of the research collaboration is to use our post-genomics combinatorial biology technology to identify novel therapeutic peptide, protein and gene products in the field of gene therapy. Cell Genesys also will be granted exclusive, royalty-free, worldwide rights to make, use and commercialize therapeutic peptide, protein and gene products in the field of gene therapy. Cell Genesys also will be granted the right to make and use the intracellular drug targets with which their gene therapy products bind for the sole purpose of the research and development of gene therapy products. Cell Genesys also has the option to obtain rights under some of our cell lines and associated technology to make and commercialize gene therapy products.

In exchange for our performance of the research and the license granted to Cell Genesys, we were granted a royalty-free, worldwide right to some Cell Genesys patents and technology pertaining to retroviral gene delivery technology for use in the field of our post-genomics combinatorial biology. Each company will pay to the other company third-party sublicensing fees and royalties associated with the grant of the licenses discussed above, and fund their own research.

Intellectual Property

We will be able to protect our technology from unauthorized use by third parties only to the extent that it is covered by valid and enforceable patents or is effectively maintained as trade secret. Accordingly, patents or other proprietary rights are an essential element of our business. We have 90 pending patent applications and seven issued patents in the United States as well as corresponding foreign patent applications. At least six patent applications have been filed in the United States by or on behalf of universities that have granted us exclusive license rights to the technology. Our policy is to file patent applications to protect technology, inventions and improvements to inventions that are commercially important to the development of our business. We seek United States and international patent protection for a variety of technologies, including: new screening methodologies and other research tools; target molecules that are associated with disease states identified in our screens; and lead compounds that can affect disease pathways. We also intend to seek patent protection or rely upon trade secret rights to protect other technologies that may be used to discover and validate targets and that may be used to identify and develop novel drugs. We seek protection, in part, through confidentiality and proprietary information agreements. We are a party to various other license agreements that give us rights to use technologies in our research and development.

Pharmexa (formerly M&E Biotech) has notified us that they have received patent protection in some European countries and Australia for a process that they assert is similar to certain aspects of our technologies. Pharmexa has notified us of its belief that we have infringed, and are contributorily infringing, certain claims of that European patent. In June 2001, we commenced administrative proceedings to oppose Pharmexa's European patent. Earlier in 2001, Pharmexa commenced an administrative proceeding to oppose our Australian patent. Legal proceedings with respect to these patents could be lengthy, costly and require significant management time and other resources, which could adversely affect the pursuit of scientific and business goals. In addition, any such legal action could result in the award of damages or a court order preventing us from using the technology covered by the Pharmexa patent. In addition, any license or other transfer of rights to the patent by Pharmexa to a third party could adversely impact our ability to obtain a license to the patent. In the event we desire to seek a license to the patent, we may not be able to obtain a license on acceptable terms. Furthermore, such failure might adversely impact our collaborations with European partners or may materially adversely affect our business in the jurisdictions that may be covered by the patent

16

protection. We are also aware that Pharmexa has sought patent protection in other countries, including the U.S., and has the option to seek patent protection in other parts of the world. If Pharmexa were to receive such patent protection, it might conflict with or overlap with the patent rights we have under U.S. Patent No. 6,153,380 and others we are pursuing. We currently do not, and do not plan to, operate in any country other than the United States.

Competition

We face, and will continue to face, intense competition from pharmaceutical and biotechnology companies, as well as from academic and research institutions and government agencies, both in the United States and abroad. Some of these competitors are pursuing the development of pharmaceuticals that target the same diseases and conditions as our research programs. Our major competitors include fully integrated pharmaceutical companies that have extensive drug discovery efforts and are developing novel small molecule pharmaceuticals. We also face significant competition from organizations that are pursuing the same or similar technologies, including the discovery of targets that are useful in compound screening, as the technologies used by us in our drug discovery efforts. Our competitors or their collaborative partners may utilize discovery technologies and techniques or partner more rapidly or successfully than we or our collaborators are able to do.

Many of these companies and institutions, either alone or together with their collaborative partners, have substantially greater financial resources and larger research and development staffs than we do. In addition, many of these competitors, either alone or together with their collaborative partners, have significantly greater experience than we do in:

Accordingly, our competitors may succeed in obtaining patent protection, identifying or validating new targets or discovering new drug compounds before we do.

Competition may also arise from:

Developments by others may render our product candidates or technologies obsolete or noncompetitive. We face and will continue to face intense competition from other companies for collaborative arrangements with pharmaceutical and biotechnology companies, for establishing relationships with academic and research institutions and for licenses to additional technologies. These competitors, either alone or with their collaborative partners, may succeed in developing technologies or products that are more effective than ours.

Our ability to compete successfully will depend, in part, on our ability to:

17

Government Regulation

If our potential preclinical compounds become ready to enter clinical testing, our ongoing development activities will be subject to extensive regulation by numerous governmental authorities in the United States and other countries, including the FDA under the Federal Food, Drug and Cosmetic Act. The regulatory review and approval process is expensive and uncertain. Securing FDA approval requires the submission of extensive preclinical and clinical data and supporting information to the FDA for each indication to establish a product candidate's safety and efficacy. The approval process takes many years, requires the expenditure of substantial resources and may involve ongoing requirements for post-marketing studies. Before commencing clinical investigations in humans, we must submit to, and receive approval from, the FDA of an IND. We expect to file our first IND with the FDA in 2002. Clinical trials are subject to oversight by institutional review boards and the FDA and:

Even if we are able to achieve success in our clinical testing, we, or our collaborative partners, must provide the FDA and foreign regulatory authorities with clinical data that demonstrates the safety and efficacy of our products in humans before they can be approved for commercial sale. None of the product candidates that we have internally developed has advanced to the stage of human testing designed to determine safety, known as Phase I clinical trials. We anticipate beginning Phase I trials in 2002, but once begun, will not know whether any such clinical trials will be successful or if such trials will be completed on schedule or at all. We also do not know whether any future clinical trials will demonstrate sufficient safety and efficacy necessary to obtain the requisite regulatory approvals or will result in marketable products. Our failure, or the failure of our strategic partners, to adequately demonstrate the safety and efficacy of our products under development will prevent receipt of FDA and similar foreign regulatory approval and, ultimately, commercialization of our products.

Any clinical trial may fail to produce results satisfactory to the FDA. Preclinical and clinical data can be interpreted in different ways, which could delay, limit or prevent regulatory approval. Negative or inconclusive results or adverse medical events during a clinical trial could cause a clinical trial to be repeated or a program to be terminated. In addition, delays or rejections may be encountered based upon additional government regulation from future legislation or administrative action or changes in FDA policy or interpretation during the period of product development, clinical trials and FDA regulatory review. Failure to comply with applicable FDA or other applicable regulatory requirements may result in criminal prosecution, civil penalties, recall or seizure of products, total or partial suspension of production or injunction, as well as other regulatory action against our potential

18

products, collaborative partners or us. Additionally, we have no experience in working with our partners in conducting and managing the clinical trials necessary to obtain regulatory approval.

Outside the United States, our ability to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical trials, marketing authorization, pricing and reimbursement vary widely from country to country. At present, foreign marketing authorizations are applied for at a national level, although within the European Union, or EU, registration procedures are available to companies wishing to market a product in more than one EU member state. If the regulatory authority is satisfied that adequate evidence of safety, quality and efficacy has been presented, a marketing authorization will be granted. This foreign regulatory approval process involves all of the risks associated with FDA clearance.

Employees

As of December 31, 2001, we employed 147 persons, of whom 46 hold Ph.D. or MD degrees and 20 hold other advanced degrees. Approximately 119 employees are engaged in research and development and 28 support administration, finance, management information systems, facilities and human resources. None of our employees is represented by a collective bargaining agreement, nor have we experienced work stoppages. We believe that our relations with our employees are good.

Scientific Advisors

We utilize scientists and physicians to advise us on scientific and medical matters as part of our ongoing research and drug development efforts, including experts in human genetics, mouse genetics, molecular biology, biochemistry, cell biology, chemistry, infectious diseases, immunology and structural biology. Generally, each of our scientific and medical advisors and consultants receives an option to purchase our common stock and an honorarium for time spent assisting us.

19

An investment in our securities is risky. Prior to making a decision about investing in our securities you should carefully consider the following risks, as well as the other information contained in this annual report on Form 10-K. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our securities could decline, and you might lose all or part of your investment. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any of these additional risks or uncertainties occur, the trading price of our securities could decline, and you might lose all or part of your investment.

Our success as a company is uncertain due to our limited operating history, our history of operating losses and the uncertainty of future profitability.

Due in large part to the significant research and development expenditures required to identify and validate new drug candidates and advance our programs toward later stages of development, we have not been profitable and have generated operating losses since we were incorporated in June 1996. Currently, our revenues are generated solely from research payments from our collaboration agreements and licenses and are insufficient to generate profitable operations. As of December 31, 2001, we had an accumulated deficit of approximately $77.8 million. We expect to incur losses for at least the next several years and expect that these losses will actually increase as we expand our research and development activities, incur significant clinical and testing costs and expand our facilities. Moreover, our losses are expected to continue even if our current research projects are able to successfully identify potential drug targets. If the time required to generate revenues and achieve profitability is longer than anticipated or if we are unable to obtain necessary capital, we may not be able to fund and continue our operations.

Because most of our expected future revenues are contingent upon collaborative and license agreements, we might not meet our strategic objectives.

Our ability to generate revenues in the near term depends on our ability to enter into additional collaborative agreements with third parties and to maintain the agreements we currently have in place. Our ability to enter into new collaborations and the revenue, if any, that may be recognized under these collaborations is highly uncertain. If we are unable to enter into new collaborations, our business prospects could be harmed, which could have an immediate adverse effect on the trading price of our stock.

To date, most of our revenues have been related to the research phase of each of our collaborative agreements. Such revenues are for specified periods and the impact of such revenues on our results of operations is partially offset by corresponding research costs. Following the completion of the research phase of each collaborative agreement, additional revenue may come only from milestone payments and royalties, which may not be paid, if at all, until some time well into the future. The risk is heightened due to the fact that unsuccessful research efforts may preclude us from receiving any milestone payments under these agreements. Our receipt of revenue from collaborative arrangements is also significantly affected by the timing of efforts expended by us and our collaborators and the timing of lead compound identification. In late 2001, we recorded the first revenue from achievement of milestones in both the Pfizer and Johnson & Johnson collaborations. Under many agreements, milestone payments may not be earned until the collaborator has advanced products into clinical testing, which may never occur or may not occur until some time well into the future. We may not recognize revenue under our collaborations when and in accordance with our expectations or the expectations of industry analysts, which could harm our business and have an immediate adverse effect on the trading price of our stock.

20

Our business plan contemplates that we will need to generate meaningful revenue from royalties and licensing agreements. To date, we have not yet received any revenue from royalties for the sale of commercial drugs, and we do not know when we will receive any such revenue, if at all. Likewise, we have not licensed any lead compounds or drug development candidates to third parties, and we do not know whether any such license will be entered into on acceptable terms in the future, if at all.

We are unable to predict when, or if, we will become profitable, and even if we are able to achieve profitability at any point in time, we do not know if our operations will be able to maintain profitability during any future periods.

There is a high risk that early-stage drug discovery and development might not successfully generate good drug candidates.

At the present time, our operations are in the early stages of drug identification and development. To date, we have only identified a few potential drug compounds, all of which are still in very early stages of development and have not yet been put into clinical testing. It is statistically unlikely that the few compounds that we have identified as potential drug candidates will actually lead to successful drug development efforts, and we do not expect any drugs resulting from our research to be commercially available for several years, if at all. Our leads for potential drug compounds will be subject to the risks and failures inherent in the development of pharmaceutical products based on new technologies. These risks include, but are not limited to, the inherent difficulty in selecting the right drug target and avoiding unwanted side effects as well as the unanticipated problems relating to product development, testing, regulatory compliance, manufacturing, marketing and competition and additional costs and expenses that may exceed current estimates.

We might not be able to commercialize our drug candidates successfully if problems arise in the testing and approval process.

Commercialization of our product candidates depends upon successful completion of preclinical studies and clinical trials. Preclinical testing and clinical development are long, expensive and uncertain processes, and we do not know whether we, or any of our collaborative partners, will be permitted to undertake clinical trials of any potential products. It may take us or our collaborative partners several years to complete any such testing, and failure can occur at any stage of testing. Interim results of trials do not necessarily predict final results, and acceptable results in early trials may not be repeated in later trials. A number of companies in the pharmaceutical industry, including biotechnology companies, have suffered significant setbacks in advanced clinical trials, even after achieving promising results in earlier trials. Moreover, if and when our projects reach clinical trials, we or our collaborative partners may decide to discontinue development of any or all of these projects at any time for commercial, scientific or other reasons. There is also a risk that competitors and third parties may develop similar or superior products or have proprietary rights that preclude us from ultimately marketing our products, as well as the potential risk that our products may not be accepted by the marketplace.

If our current corporate collaborations or license agreements are unsuccessful or if conflicts develop with these relationships, our research and development efforts could be delayed.

Our strategy depends upon the formation and sustainability of multiple collaborative arrangements and license agreements with third parties in the future. We rely on these arrangements for not only financial resources, but also for expertise that we expect to need in the future relating to clinical trials, manufacturing, sales and marketing, and for licenses to technology rights. To date, we have entered into several such arrangements with corporate collaborators; however, we do not know if such third parties will dedicate sufficient resources or if any such development or commercialization efforts by third parties will be successful. Should a collaborative partner fail to develop or commercialize a compound or product to which it has rights from us, we may not receive any future milestone payments and will

21

not receive any royalties associated with such compound or product. In addition, the continuation of some of our partnered drug discovery and development programs may be dependent on the periodic renewal of our corporate collaborations. For example, the funded research phase of our collaboration with Pfizer has been completed and the development portion of our collaboration is ongoing at Pfizer. More generally, our corporate collaboration agreements may terminate before the full term of the collaborations or upon a breach or a change of control. We may not be able to renew these collaborations on acceptable terms, if at all, or negotiate additional corporate collaborations on acceptable terms, if at all.

We are also a party to various license agreements that give us rights to use specified technologies in our research and development processes. The agreements, pursuant to which we have in-licensed technology, permit our licensors to terminate the agreements under certain circumstances. If we are not able to continue to license these and future technologies on commercially reasonable terms, our product development and research may be delayed.

Conflicts might also arise with respect to our various relationships with third parties. If any of our corporate collaborators were to breach or terminate their agreement with us or otherwise fail to conduct the collaborative activities successfully and in a timely manner, the preclinical or clinical development or commercialization of the affected product candidates or research programs could be delayed or terminated. We generally do not control the amount and timing of resources that our corporate collaborators devote to our programs or potential products. We do not know whether current or future collaborative partners, if any, might pursue alternative technologies or develop alternative products either on their own or in collaboration with others, including our competitors, as a means for developing treatments for the diseases targeted by collaborative arrangements with us. Conflicts also might arise with collaborative partners concerning proprietary rights to particular compounds. While our existing collaborative agreements typically provide that we retain milestone payments and royalty rights with respect to drugs developed from certain derivative compounds, any such payments or royalty rights may be at reduced rates, and disputes may arise over the application of derivative payment provisions to such drugs, and we may not be successful in such disputes.

If we fail to enter into new collaborative arrangements in the future, our business and operations would be negatively impacted.

Although we have established several collaborative arrangements and various license agreements, we do not know if we will be able to establish additional arrangements, or whether current or any future collaborative arrangements will ultimately be successful. For example, there have been, and may continue to be, a significant number of recent business combinations among large pharmaceutical companies that have resulted, and may continue to result, in a reduced number of potential future corporate collaborators, which may limit our ability to find partners who will work with us in developing and commercializing our drug targets. If business combinations involving our existing corporate collaborators were to occur, the effect could be to diminish, terminate or cause delays in one or more of our corporate collaborations.

We will need additional capital in the future to sufficiently fund our operations and research.

Our operations require significant additional funding in large part due to our research and development expenses, future preclinical and clinical-testing costs, the expansion of our facilities and the absence of any meaningful revenues over the foreseeable future. The amount of future funds needed will depend largely on the success of our collaborations and our research activities, and we do not know whether additional financing will be available when needed, or that, if available, we will obtain financing on terms favorable to our stockholders or us. We have consumed substantial amounts of capital to date, and operating expenditures are expected to increase over the next several years as we expand our infrastructure and research and development activities.

22

We believe that our existing capital resources, including the funds received in the January and February 2002 offerings, together with the proceeds from current and future collaborations and tenant improvement financings, will be sufficient to support our current operating plan for at least the next 18 months. We will require additional financing in the future to fund our operations. Our future funding requirements will depend on many factors, including, but not limited to:

To the extent we raise additional capital by issuing equity securities, our stockholders may experience substantial dilution. To the extent that we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish some rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If adequate funds are not available, we will not be able to continue developing our products.

Our success is dependent on intellectual property rights held by us and third parties, and our interest in such rights is complex and uncertain.

Our success will depend to a large part on our own, our licensees' and our licensors' ability to obtain and defend patents for each party's respective technologies and the compounds and other products, if any, resulting from the application of such technologies. Seven U.S. patents have been issued to us as of December 31, 2001, and we have numerous applications in the U.S. and abroad awaiting approval. In the future, our patent position might be highly uncertain and involve complex legal and factual questions. No consistent policy regarding the breadth of claims allowed in biotechnology patents has emerged to date. Accordingly, we cannot predict the breadth of claims allowed in our or other companies' patents.

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

23

We rely on trade secrets to protect technology where we believe patent protection is not appropriate or obtainable. However, trade secrets are difficult to protect. While we require employees, collaborators and consultants to enter into confidentiality agreements, we may not be able to adequately protect our trade secrets or other proprietary information in the event of any unauthorized use or disclosure or the lawful development by others of such information.

We are a party to certain in-license agreements that are important to our business, and we generally do not control the prosecution of in-licensed technology. Accordingly, we are unable to exercise the same degree of control over this intellectual property as we exercise over our internally-developed technology. Moreover, some of our academic institution licensors, research collaborators and scientific advisors have rights to publish data and information in which we have rights. If we cannot maintain the confidentiality of our technology and other confidential information in connection with our collaborations, then our ability to receive patent protection or protect our proprietary information will be impaired. In addition, some of the technology we have licensed relies on patented inventions developed using U.S. government resources. The U.S. government retains certain rights, as defined by law, in such patents, and may choose to exercise such rights.

If a dispute arises regarding the infringement or misappropriation of the proprietary rights of others, such dispute could be costly and result in delays in our research and development activities.

Our success will also depend, in part, on our ability to operate without infringing or misappropriating the proprietary rights of others. There are many issued patents and patent applications filed by third parties relating to products or processes that are similar or identical to ours or our licensors, and others may be filed in the future. There can be no assurance that our activities, or those of our licensors, will not infringe patents owned by others. We believe that there may be significant litigation in the industry regarding patent and other intellectual property rights, and we do not know if we or our collaborators would be successful in any such litigation. Any legal action against our collaborators or us claiming damages or seeking to enjoin commercial activities relating to the affected products, our methods or processes could:

24

Pharmexa (formerly M&E Biotech) has notified us that they have received patent protection in some European countries and Australia for a process they assert is similar to certain aspects of our technologies. Pharmexa has notified us of its belief that we have infringed, and are contributorily infringing, certain claims of that European patent. In June 2001, we commenced administrative proceedings to oppose Pharmexa's European patent. Earlier in the year, Pharmexa commenced an administrative proceeding to oppose our Australian patent. Legal proceedings with respect to these patents could be lengthy, costly and require significant management time and other resources, which could adversely affect the pursuit of scientific and business goals. In addition, any such legal action could result in the award of damages or a court order preventing us from using the technology covered by the Pharmexa patent. In addition, any license or other transfer of rights to the patent by Pharmexa to a third party could adversely impact our ability to obtain a license to the patent. In the event we desire to seek a license to the patent, we may not be able to obtain a license on acceptable terms. Furthermore, such failure might adversely impact our collaborations with European partners or may materially adversely affect our business in the jurisdictions that may be covered by the patent protection. We are also aware that Pharmexa has sought patent protection in other countries, including the U.S., and has the option to seek patent protection in other parts of the world. If Pharmexa were to receive such patent protection, it might conflict with or overlap with the patent rights we have under U.S. Patent No. 6,153,380 and others we are pursuing. We currently do not, and do not plan to, operate in any country other than the United States.

If we are unable to obtain regulatory approval to market products in the United States and foreign jurisdictions, we might not be permitted to commercialize products from our research.

Due, in part, to the early stage of our drug candidate research and development process, we cannot predict whether regulatory clearance will be obtained for any product we, or our collaborative partners, hope to develop. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. Of particular significance to us are the requirements covering research and development and testing.

Before commencing clinical trials in humans, we, or our collaborative partners, will need to submit and receive approval from the FDA of an IND. If regulatory clearance of a product is granted, this clearance will be limited to those disease states and conditions for which the product is demonstrated through clinical trials to be safe and efficacious. We cannot ensure that any compound developed by us, alone or with others, will prove to be safe and efficacious in clinical trials and will meet all of the applicable regulatory requirements needed to receive marketing clearance.

Outside the United States, our ability, or that of our collaborative partners, to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. This foreign regulatory approval process typically includes all of the risks associated with FDA clearance described above and may also include additional risks.

We may encounter difficulties in managing our growth, and these difficulties could increase our losses.

We have experienced a period of rapid and substantial growth that has placed, and will continue to place, a strain on our human and capital resources. The number of our employees increased from 31 at December 31, 1997 to 147 at December 31, 2001. Our ability to manage our operations and growth effectively requires us to continue to use funds to improve our operational, financial and management controls, reporting systems and procedures and to attract and retain sufficient numbers of talented employees. If we are unable to manage this growth effectively, our losses will increase.

25

If our competitors develop technologies that are more effective than ours, our commercial opportunity will be reduced or eliminated.