SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant o | ||

Check the appropriate box: |

||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under Rule 14a-12 |

|

RIGEL PHARMACEUTICALS, INC. |

|

| (Name of Registrant as Specified In Its Charter) | |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(6) |

Amount Previously Paid: |

|||

| (7) | Form, Schedule or Registration Statement No.: |

|||

| (8) | Filing Party: |

|||

| (9) | Date Filed: |

|||

RIGEL PHARMACEUTICALS, INC.

240 East Grand Avenue

South San Francisco, California 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 20, 2002

TO THE STOCKHOLDERS OF RIGEL PHARMACEUTICALS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of RIGEL PHARMACEUTICALS, INC., a Delaware corporation (the "Company"), will be held on Thursday, June 20, 2002 at 10:00 a.m., local time, at the Company's executive offices, located at 240 East Grand Avenue, South San Francisco, California 94080, for the following purposes:

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on May 1, 2002, as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

| By Order of the Board of Directors | |

|

|

| James H. Welch Secretary |

|

South San Francisco, California May 15, 2002 |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME. YOU MAY ALSO BE ABLE TO SUBMIT YOUR PROXY OVER THE INTERNET OR BY TELEPHONE; PLEASE REFER TO THE INFORMATION PROVIDED WITH YOUR PROXY CARD.

RIGEL PHARMACEUTICALS, INC.

240 East Grand Avenue

South San Francisco, California 94080

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

June 20, 2002

INFORMATION CONCERNING SOLICITATION AND VOTING

GENERAL

The enclosed proxy is solicited on behalf of the board of directors of Rigel Pharmaceuticals, Inc., a Delaware corporation, for use at the Annual Meeting of Stockholders to be held on Thursday, June 20, 2002, at 10:00 a.m., local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at our executive offices, located at 240 East Grand Avenue, South San Francisco, California 94080. We intend to mail this proxy statement and accompanying proxy card on or about May 15, 2002 to all stockholders entitled to vote at the Annual Meeting.

SOLICITATION

Rigel will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to the stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our common stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of our common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by our directors, officers or other regular employees. No additional compensation will be paid to our directors, officers or other regular employees for such services.

VOTING RIGHTS AND OUTSTANDING SHARES

Only holders of record of our common stock at the close of business on May 1, 2002 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on May 1, 2002, we had outstanding and entitled to vote 45,305,663 shares of common stock. Each holder of record of our common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will

have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether a matter has been approved.

VOTING VIA THE INTERNET OR BY TELEPHONE

General Information for all Shares Voted Via the Internet or By Telephone

Stockholders may grant a proxy to vote their shares on the Internet or by means of the telephone. The law of Delaware, under which the Company is incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the stockholder.

The Internet and telephone voting procedures below are designed to authenticate stockholders' identities, to allow stockholders to grant a proxy to vote their shares and to confirm that stockholders' instructions have been recorded properly. Stockholders granting a proxy to vote via the Internet should understand that there may be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies, that must be borne by the stockholder.

For Shares Registered in Your Name

Stockholders of record may go to http://www.eproxy.com/rigl/ to grant a proxy to vote their shares by means of the Internet. They will be required to provide the company number and control number contained on their proxy cards. The voter will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen and the voter will be prompted to submit or revise them as desired. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-240-6326 and following the recorded instructions.

You may use the Internet to vote your proxy 24 hours a day, seven days a week, until 12:00 p.m. Central Daylight Time on June 19, 2002. You may use any touch-tone telephone to vote your proxy 24 hours a day, seven days a week, until 11:00 a.m. Central Daylight Time on June 19, 2002. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive voting instruction forms from their banks, brokers or other agents, rather than Rigel's proxy card. A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers the means to grant proxies to vote shares by means of the telephone and Internet. If your shares are held in an account with a broker or bank participating in the ADP Investor Communications Services program, you may grant a proxy to vote those shares telephonically by calling the telephone number shown on the instruction form received from your broker or bank, or via the Internet at ADP Investor Communication Services' web site at http://www.proxyvote.com/.

REVOCABILITY OF PROXIES

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. Your proxy may be revoked by filing with the secretary of Rigel at our executive offices, 240 East Grand Avenue, South San Francisco, California 94080, a written notice of revocation or a duly executed proxy bearing a later date. Your proxy may also be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke your proxy.

2

STOCKHOLDER PROPOSALS

The deadline for submitting a stockholder proposal for inclusion in our proxy statement and form of proxy for our 2003 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission is January 15, 2003. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must do so between February 20, 2003 and March 22, 2003. Stockholders are also advised to review our bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

PROPOSAL 1

ELECTION OF CLASS II DIRECTORS

Our restated certificate of incorporation and bylaws provide that our board of directors shall be divided into three classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the board may be filled only by persons elected by a majority of the remaining directors. A director elected by the board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director's successor is elected and qualified.

The board of directors is presently composed of seven members. There are three directors in Class II, the class whose term of office expires in 2002. Each of the nominees for election to this class is currently a director who was previously elected by our stockholders. If elected at our annual meeting, each of the nominees would serve until our 2005 annual meeting and until his or her successor is elected and has qualified, or until his or her earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at our annual meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Set forth below is biographical information for each person nominated and each person whose term of office as a director will continue after our annual meeting.

NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2005 ANNUAL MEETING

Walter H. Moos, PhD, age 47, joined us as a director in March 1997. Since 1997, Dr. Moos has served as the Chairman and Chief Executive Officer of MitoKor, a biotechnology company. From 1991 to 1997, he served as Corporate Vice President and Vice President, Research and Development in the Technologies Division of Chiron Corporation, a biotechnology company. From 1982 to 1991, Dr. Moos held several positions at the Parke-Davis Pharmaceutical Research Division of the Warner-Lambert Company, last holding the position of Vice President, Neuroscience and Biological Chemistry. He has been an Adjunct Professor at the University of California, San Francisco, since 1992. Dr. Moos holds an AB from Harvard University and a PhD in chemistry from the University of California, Berkeley.

Stephen A. Sherwin, MD, age 53, joined us as a director in March 2000. Since March 1990, he has served as Chief Executive Officer and director of Cell Genesys, Inc., and as Chairman of the Board of Cell Genesys since March 1994. From March 1990 to August 2001, Dr. Sherwin held the additional position of President of Cell Genesys. From 1983 to 1990, Dr. Sherwin held various positions at Genentech Inc., a biopharmaceutical company, most recently as Vice President, Clinical Research.

3

Dr. Sherwin currently serves as Chairman of the Board of Ceregene, Inc., a majority-owned subsidiary of Cell Genesys, and as a director of Abgenix, Inc. and Neurocrine Biosciences, Inc. He received his MD from Harvard Medical School and his BA from Yale University.

Thomas S. Volpe, age 51, joined us as a director in August 2000. Mr. Volpe is the Chairman and Chief Executive Officer of Volpe Investments, LLC, a risk capital investment firm. Until May 2001, he was the Chairman of Prudential Volpe Technology Group. From 1986 to 1999, Mr. Volpe was President, Chief Executive Officer and founder of Volpe Brown Whelan & Company, a risk capital and investment banking firm focused on rapidly growing entrepreneurial companies. Prior to forming Volpe Brown Whelan & Company, he was President, Chief Executive Officer and a member of the board of directors and management committee of Hambrecht & Quist Incorporated. Before joining Hambrecht & Quist, Mr. Volpe was Head of the Science and Technology Group of Blyth Eastman PaineWebber. Mr. Volpe also serves on the board of directors of Linear Technology Corporation. Mr. Volpe holds an AB in economics from Harvard University, an MSc in economics from the London School of Economics and an MBA from the Harvard Business School.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

CLASS III DIRECTORS CONTINUING IN OFFICE UNTIL THE 2003 ANNUAL MEETING

James M. Gower, age 53, has been our Chairman of the Board and Chief Executive Officer since October 2001. Mr. Gower joined us as our President, Chief Executive Officer and as a member of our board of directors in January 1997. From 1992 to March 1996, Mr. Gower was President and Chief Executive Officer of Tularik Inc., a biotechnology company developing small-molecule drugs regulating gene expression. Prior to Tularik, Mr. Gower spent ten years at Genentech, Inc., a biopharmaceutical company, where he most recently served as Senior Vice President. During his ten years at Genentech, Mr. Gower was responsible for business development and sales and marketing functions. In addition, he established and managed Genentech's foreign operations in Canada and Japan and served as President of Genentech Development Corporation. Mr. Gower serves on the board of directors of Cell Genesys, Inc. He holds a BS and an MBA in operations research from the University of Tennessee.

Donald G. Payan, MD, age 53, is our co-founder, has been a member of our board of directors since July 1996 and has served as our Executive Vice President and Chief Scientific Officer since January 1997. From January 1997 to July 1998, he also served as our Chief Operating Officer. From July 1996 to January 1997, Dr. Payan served as our President and Chief Executive Officer. From December 1995 to May 1996, Dr. Payan was Vice President of AxyS Pharmaceuticals, Inc., a biopharmaceutical company. From September 1993 to December 1995, Dr. Payan was the founder and Executive Vice President and Chief Scientific Officer of Khepri Pharmaceuticals, Inc., which merged with AxyS Pharmaceuticals. Dr. Payan continues his association with the University of California, San Francisco, which began in 1982, where he is currently an Adjunct Professor of Medicine and Surgery. Dr. Payan holds a BS and an MD from Stanford University.

CLASS I DIRECTORS CONTINUING IN OFFICE UNTIL THE 2004 ANNUAL MEETING

Jean Deleage, PhD, age 61, joined us as a director in January 1997. Dr. Deleage is a founder and managing director of Alta Partners, a venture capital firm investing in information technologies and life sciences companies. Dr. Deleage is a managing partner of Burr, Egan, Deleage & Co., a venture capital firm that he founded in 1979. Dr. Deleage was a founder of Sofinnova, a venture capital organization in France, and Sofinnova, Inc., the U.S. subsidiary of Sofinnova. Dr. Deleage currently serves on the board of directors of Aclara Biosciences, Inc., Crucell, N.V., Kosan Biosciences, Inc. and Telik, Inc. Dr. Deleage received a Baccalaureate in France, a Masters Degree in electrical engineering from the Ecole Superieure d'Electricite and a PhD in economics from the Sorbonne.

4

Alan D. Frazier, age 49, joined us as a director in October 1997. In 1991, Mr. Frazier founded Frazier & Company, a venture capital firm, and has served as the managing principal since its inception. From 1983 to 1991, Mr. Frazier served as Executive Vice President, Chief Financial Officer and Treasurer of Immunex Corporation, a biopharmaceutical company. From 1980 to 1983, Mr. Frazier was a principal in the Audit Department of Arthur Young & Company (now Ernst & Young). He also serves on the board of trustees of the Fred Hutchinson Cancer Research Center, the Technology Alliance of Washington, Voyager Capital's Advisory Board and the Washington Venture Capital Association. Mr. Frazier holds a BA in economics from the University of Washington.

BOARD COMMITTEES AND MEETINGS

During the fiscal year ended December 31, 2001, the board of directors held five meetings. The board has an audit committee and a compensation committee.

Our audit committee meets with our independent auditors at least annually to review the results of our annual audit and discuss our financial statements; recommends to the board the independent auditors to be retained; oversees the independence of the independent auditors; evaluates the independent auditors' performance; and receives and considers the independent auditors' comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. Our audit committee is currently composed of three non-employee directors: Drs. Delage and Sherwin and Mr. Volpe. Mr. Volpe replaced Dr. Moos in January 2001. Our audit committee met three times during the fiscal year ended December 31, 2001. All members of our audit committee are independent (as independence is defined in Rule 4200(a)(15) of the NASD listing standards).

Our compensation committee makes recommendations concerning salaries and incentive compensation, awards stock options to employees and consultants under our stock option plans and otherwise determines compensation levels and performs such other functions regarding compensation as the board may delegate. Our compensation committee is currently composed of two non-employee directors: Mr. Frazier and Dr. Moos. Our compensation committee met four times during the fiscal year ended December 31, 2001.

During the fiscal year ended December 31, 2001, each of the directors attended at least 75% or more of the total meetings of the board and of the committees on which they served, held during the period for which they were a director or committee member, respectively.

5

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS1

The Rigel Pharmaceuticals, Inc. Board of Directors' Audit Committee is comprised of three directors who are not officers of Rigel. Under currently applicable rules, all members are independent. The Board of Directors has adopted a written charter for the Audit Committee.

In the Audit Committee's meeting to review the financial statements for the fiscal year ended December 31, 2001, the Audit Committee reviewed and discussed the audited financial statements with management and Ernst & Young LLP. The Audit Committee believes that management maintains an effective system of internal controls that results in fairly presented financial statements. Based on these discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in Rigel's Annual Report on Form 10-K for the fiscal year ended December 31, 2001.

The discussions with Ernst & Young LLP also included the matters required by Statement on Auditing Standards No. 61. The Audit Committee received from Ernst & Young LLP written disclosures and the letter regarding its independence as required by Independence Standards Board Standard No. 1. This information was discussed with Ernst & Young LLP.

The undersigned members of the Audit Committee have submitted this Audit Committee Report as of this 30th day of April, 2002:

| |

|

|

|---|---|---|

| Jean Deleage, Ph.D. | ||

Stephen A. Sherwin, M.D. |

||

Thomas S. Volpe |

6

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The board has selected Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2002 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited our financial statements since our inception in 1996. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of Ernst & Young LLP as our independent auditors is not required by our bylaws or otherwise. However, the board is submitting the selection of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee and the board will reconsider whether or not to retain that firm. Even if the selection is ratified, our audit committee and the board in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in Rigel's best interests and in the best interests of the stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Ernst & Young LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Audit Fees. During the fiscal year ended December 31, 2001, the aggregate fees billed by Ernst & Young LLP for the audit of our financial statements for such fiscal year and for the reviews of our interim financial statements were $131,394.

Financial Information Systems Design and Implementation Fees. During the fiscal year ended December 31, 2001, we were not billed by Ernst & Young LLP for any fees relating to information technology consulting.

All Other Fees. During the fiscal year ended December 31, 2001, the aggregate fees billed by Ernst & Young LLP for professional services other than audit and information technology consulting fees were $38,850.

Our audit committee has determined the rendering of all other non-audit services by Ernst & Young LLP is compatible with maintaining the auditors' independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

7

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows information known to us with respect to the beneficial ownership of our common stock as of April 16, 2002, by:

Beneficial ownership of shares is determined under the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Except as indicated by footnote, and subject to applicable community property laws, each person identified in the table possesses sole voting and investment power with respect to all shares of common stock held by them. Shares of common stock subject to options currently exercisable or exercisable within 60 days of April 16, 2002 and not subject to repurchase as of that date are deemed outstanding for calculating the percentage of outstanding shares of the person holding these options, but are not deemed outstanding for calculating the percentage of beneficial ownership of any other person. Applicable percentage ownership in the following table is based on 45,305,663 shares of common stock outstanding as of April 16, 2002. Unless otherwise indicated, the address of each of the named individuals is c/o Rigel Pharmaceuticals, Inc., 240 East Grand Avenue, South San Francisco, California 94080.

| Beneficial Owner |

Outstanding Shares of Common Stock |

Shares Issuable Pursuant to Options Exercisable Within 60 Days of April 16, 2002 |

Percent of Total Outstanding Shares Beneficially Owned(1) |

||||

|---|---|---|---|---|---|---|---|

| Five percent stockholders | |||||||

| Entities affiliated with Lombard Odier & Cie(1) 11, rue de la Corraterie 1204 Geneva 11 Switzerland |

6,269,538 | — | 13.8 | % | |||

Entities affiliated with Alta Partners(2) One Embarcadero Center, Suite 4050 San Francisco, CA 94111 |

5,832,923 |

— |

12.9 |

% |

|||

Entities affiliated with Frazier and Company, Inc.(3) 601 Union Street, Suite 2110 Seattle, WA 98101 |

4,347,719 |

— |

9.6 |

% |

|||

Novartis Pharma AG Head Financial Investments CH-4002 Basil, Switzerland |

3,428,571 |

— |

7.6 |

% |

8

Directors and named executive officers |

|||||||

| James M. Gower | 507,142 | 300,000 | 1.8 | % | |||

| Donald G. Payan, MD | 750,000 | 100,000 | 1.9 | % | |||

| Brian C. Cunningham | 203,159 | 299,999 | 1.1 | % | |||

| James H. Welch | 40,465 | 84,166 | * | ||||

| Raul Rodriguez | 3,280 | 142,916 | * | ||||

| Jean Deleage, PhD(2) | 5,832,923 | 2,083 | 12.9 | % | |||

| Alan D. Frazier(3) | 4,347,719 | — | 9.6 | % | |||

| Walter H. Moos, PhD | — | 22,083 | * | ||||

| Stephen A. Sherwin, MD | — | 28,424 | * | ||||

| Thomas S. Volpe | 33,333 | 19,583 | * | ||||

| All executive officers and directors as a group (11 people) | 11,722,793 | 1,107,389 | 28.3 | % |

COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2001, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

9

COMPENSATION OF EXECUTIVE OFFICERS

The following table sets forth information concerning the compensation that we paid during the fiscal years ended December 31, 2001, 2000 and 1999 to our Chief Executive Officer and each of our four other most highly compensated executive officers who earned more than $100,000 during 2001.

| |

|

|

|

Long-Term Compensation |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|||||||||||||

| Name and Principal Position |

Securities Underlying Options/SARS(1) |

All Other Compensation |

||||||||||||

| Year |

Salary |

Bonus |

||||||||||||

| James M. Gower Chief Executive Officer, Chairman of the Board and Director |

2001 2000 1999 |

$ |

288,837 267,800 255,000 |

$ |

50,000 — — |

— — 450,000 |

— — — |

|||||||

Donald G. Payan, MD Executive Vice President and Chief Scientific Officer and Director |

2001 2000 1999 |

263,833 247,200 235,417 |

60,000 — — |

— — 150,000 |

— — — |

|||||||||

Brian C. Cunningham President and Chief Operating Officer |

2001 2000 1999 |

269,626 257,500 250,000 |

50,000 — — |

— 200,000 — |

— — — |

|||||||||

James H. Welch Vice President, Chief Financial Officer and Secretary |

2001 2000 1999 |

163,271 154,500 100,000 |

30,000 — 25,000 |

— 50,000 150,000 |

— — — |

|||||||||

Raul Rodriguez(2) Vice President, Business Development |

2001 2000 1999 |

216,321 165,000 — |

15,000 — — |

— 245,000 — |

$ |

— 12,226 — |

(3) |

|||||||

We did not make any option grants to our Chief Executive Officer or any of our four other most highly paid executive officers during 2001.

The following table sets forth summary information regarding the number and value of shares acquired upon exercise of options in 2001 and options held as of December 31, 2001 for our Chief Executive Officer and each of our four most highly compensated executive officers. Amounts shown in the "Value of Unexercised In-the-Money Options at December 31, 2001" column are based on the closing market price on December 31, 2001 of $4.65 per share, without taking into account any taxes that may be payable in connection with the transaction, multiplied by the number of shares underlying the option, less the aggregate exercise price payable for these shares.

10

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| |

|

|

Number of Securities Underlying Unexercised Options at December 31, 2001 |

|

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Value of Unexercised In-the-Money Options at December 31, 2001 |

|||||||||||

| Name |

Shares Acquired on Exercise |

Value Realized |

||||||||||||

| Vested |

Unvested |

Vested |

Unvested |

|||||||||||

| James M. Gower | — | — | 255,000 | 195,000 | $ | 1,134,750 | $ | 867,750 | ||||||

| Donald G. Payan, MD | — | — | 85,000 | 65,000 | 378,250 | 289,250 | ||||||||

| Brian C. Cunningham | — | — | 237,499 | 262,501 | 651,872 | 728,128 | ||||||||

| James H. Welch | — | — | 63,958 | 98,542 | 181,594 | 326,531 | ||||||||

| Raul Rodriguez | — | — | 112,291 | 132,709 | 16,844 | 19,906 | ||||||||

COMPENSATION OF DIRECTORS

We do not provide cash compensation to members of the board of directors for serving on the board of directors or for attendance at committee meetings. The members of the board of directors are eligible for reimbursement for their expenses incurred in connection with attendance at board meetings in accordance with Rigel policy.

Each of our non-employee directors also receives stock option grants under the 2000 Non-Employee Directors' Stock Option Plan, or Directors' Plan. Only non-employee directors or their affiliates are eligible to receive options under the Directors' Plan. Options granted under the Directors' Plan are not intended to qualify as incentive stock options under the Internal Revenue Code of 1986, as amended.

Option grants under the Directors' Plan are non-discretionary. Each person who is elected or appointed for the first time to be a non-employee director automatically receives, upon the date of his or her initial election or appointment to be a non-employee director by the board or Rigel stockholders, an initial grant to purchase 20,000 shares of common stock on the terms and conditions set forth in the plan. In addition, on the day following the annual meeting of stockholders each year, each non-employee director who continues to serve as a non-employee director automatically receives an annual option to purchase 5,000 shares of common stock. No other options may be granted at any time under the Directors' Plan. The exercise price of options granted under the Directors' Plan is 100% of the fair market value of our common stock on the date of the option grant. The options vest over two years in equal monthly installments provided that the non-employee director continues to provide services to Rigel. The term of options granted under the Directors' Plan is ten years. In the event of a merger of Rigel with or into another corporation or a consolidation, acquisition of assets or other change-in-control transaction involving us, each option either will continue in effect, if Rigel is the surviving entity, or if neither assumed nor substituted, will accelerate and the option will terminate if not exercised prior to the consummation of the transaction.

Pursuant to the Directors' Plan, on July 19, 2001, the day after our 2001 annual meeting of stockholders, we granted options covering 5,000 shares of common stock to each of Drs. Deleage, Moos and Sherwin and Mr. Volpe, each at an exercise price of $8.17 per share. These options vest in a series of 24 equal monthly installments beginning on the grant date. Mr. Frazier declined the option grant he would have otherwise received under the Directors' Plan during 2001.

EMPLOYMENT CONTRACTS AND TERMINATION OF EMPLOYMENT AND CHANGE OF CONTROL ARRANGEMENTS

We have an employment agreement with Dr. Payan, our Executive Vice President and Chief Scientific Officer, dated as of January 16, 1997, and continuing indefinitely. Under the agreement, Dr. Payan is entitled to receive an annualized base salary of $185,000 and was issued 750,000 shares of our common stock. As of January 16, 2000, all such shares were fully vested and not subject to a right of repurchase by us. Either Rigel or Dr. Payan may terminate his employment at any time for any reason. If we terminate Dr. Payan's employment without cause, he will receive a severance payment equal to one year's base salary.

11

REPORT OF THE COMPENSATION COMMITTEE OF

THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION2

The Compensation Committee of the Board of Directors of Rigel Pharmaceuticals, Inc. ("Rigel" or the "Company") is composed of two non-employee directors and is responsible for making recommendations to the Company's Board of Directors concerning salaries and incentive compensation for all employees, including executive officers. The Compensation Committee also has the authority and power to administer the Company's equity incentive plans and grant stock options to the Company's employees and consultants pursuant to such plans.

Compensation Philosophy

The Company's compensation program seeks to align compensation with business objectives and individual performance, and to enable the Company to attract, retain and motivate all employees, including executive officers, who are expected to contribute to the long-term success of the Company. The Company's compensation philosophy is based on the principles of competitive and fair compensation and sustained performance.

Compensation for the Company's employees, including executive officers, is set so as to be comparable with employees and executive officers having similar responsibilities at similarly-sized publicly-traded biopharmaceutical companies located in Northern California. Every employee's salary is adjusted annually, based on individual performance, corporate performance and the relative compensation of the employee as compared to data collected from surveys of comparable compensation levels.

Prior to 2001, the Company's compensation practices had been measured against other similar private biopharmaceutical companies in Northern California. In connection with Rigel's transition into a publicly-traded company in late 2000, the Compensation Committee requested that an independent compensation consulting firm review and make recommendations for the Company's compensation policies to ensure that Rigel's practices were appropriate and competitive with similarly-sized publicly-traded biopharmaceutical companies in Northern California.

Elements of Annual Compensation

Salary. The salary for Rigel's executives officers and employees is determined by reviewing compensation for competitive positions in similarly-sized publicly-traded biopharmaceutical companies in Northern California, as well as the historical compensation levels of each position. Increases in annual salaries are based on actual corporate and individual performance against targeted performance and various subjective performance criteria. Targeted performance criteria vary for each executive or employee and are based on his or her area of responsibility. Subjective performance criteria include an executive's or employee's ability to motivate others, develop the skills necessary to mature with the Company and recognize and pursue new business opportunities to enhance the Company's growth and success. The Compensation Committee does not use a specific formula based on these targeted performance and subjective criteria, but instead makes an evaluation of each employee's contributions in light of all such criteria.

Bonus. Cash bonuses for the Company's executives and employees are awarded from time to time at the discretion of the Compensation Committee in the recognition of performance that the

12

Compensation Committee determines to incrementally contribute to the Company's growth and increased stockholder value.

Long-Term Incentives. In order to align the long-term interests of employees with those of stockholders, the Company grants all employees, including executives, options to purchase stock. Options also align the Company's employee retention efforts with stockholder interests by playing a critical role in the retention of employees that the Compensation Committee determines to have a significant role in the success of the Company. Options are granted with an exercise price set at the fair market value of the Company's stock on the date of grant and provide economic value only when the price of the Company's stock increases above the exercise price. The size of each grant is generally intended to reflect the employee's position within the Company, the quantity and vesting status of options already held by the employee, if any, and the employee's contributions to the Company. Options are subject to vesting provisions designed to encourage employees to remain with the Company. For the year ended December 31, 2001, there were no options granted to the Company's executive officers.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to publicly-held companies for compensation in excess of $1.0 million paid to the corporation's chief executive officer and the four other most highly-compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. The Company generally intends to structure the stock options granted to its executive officers in a manner that complies with this statute to mitigate any disallowance of deductions under Section 162(m). However, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be in excess of the limit when the Compensation Committee believes such payment is appropriate, after taking into consideration changing business conditions, the officer's performance and the best interests of the Company's stockholders.

Compensation for Mr. James Gower, Chairman and CEO

The Compensation Committee believes that Mr. Gower's salary for the fiscal year ended December 31, 2001 was consistent with the criteria described above and with the Compensation Committee's evaluation of his overall leadership and management of Rigel. No stock options were granted to Mr. Gower as compensation for fiscal year 2001. In July 2001, upon recommendation from the independent compensation consulting firm engaged by the Compensation Committee, Mr. Gower received a salary increase of 20%, increasing his annual salary from $275,600 to $330,000. The increase in July reflected an adjustment in the Company's compensation practices resulting from to the Company's transition into a publicly-traded company. Therefore, the Compensation Committee increased Mr. Gower's salary to a level that the Compensation Committee believed was comparable with averages of other CEOs of other similarly-sized publicly-traded biopharmaceutical companies and consistent with the guidelines used throughout the Company. Rigel paid Mr. Gower a cash bonus of $50,000 in January 2001 as compensation for his services during fiscal year 2000. Mr. Gower did not receive a cash bonus as compensation for his services during fiscal year 2001.

Summary

The Compensation Committee believes that the Company's compensation policy has been successful in attracting and retaining qualified employees and in tying compensation directly to corporate performance relative to corporate goals. The Compensation Committee engaged an independent compensation consulting firm to review the Company's compensation policies and make recommendations to ensure that Rigel's compensation practices were competitive. Not all elements of the recommended compensation plans presented by the independent consulting firm were implemented

13

in 2001, yet the Compensation Committee believes that the consulting firm provided a valuable guide for structuring and maintaining competitive salaries and incentives for Rigel's employees and executive officers. The Company expects its compensation practices and policies to continue to evolve over time as it attempts to satisfy the expectations and needs of its employees while maintaining the Company's focus on building long-term stockholder value in a highly competitive and rapidly changing business environment.

The undersigned members of the Compensation Committee have submitted this Report of the Compensation Committee as of this 26th day of April, 2002:

| |

|

|

|---|---|---|

| Alan D. Frazier | ||

Walter H. Moos, PhD |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Rigel's compensation committee currently consists of Mr. Frazier and Dr. Moos. No current member of the compensation committee has been an officer or employee of Rigel at any time. None of Rigel's executive officers serves as a member of the board of directors or compensation committee of any other company that has one or more executive officers serving as a member of Rigel's board of directors or compensation committee. Prior to the formation of a compensation committee in February 1998, the Board of Directors as a whole made decisions relating to compensation of our executive officers.

14

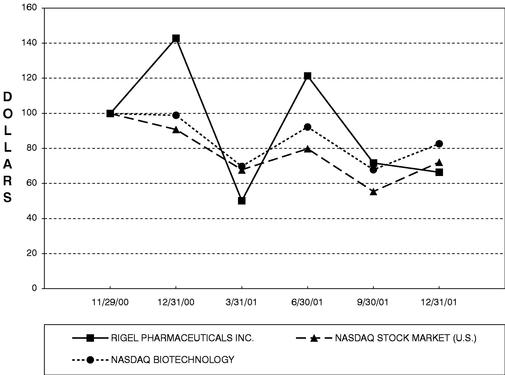

PERFORMANCE MEASUREMENT COMPARISON3

The rules of the SEC require that we include in our proxy statement a line-graph presentation comparing cumulative stockholder returns on our common stock with the Nasdaq Composite Index (which tracks the aggregate price performance of equity securities of companies traded on the Nasdaq) and either a published industry or line-of-business standard index or an index of peer companies selected by us. We have elected to use the Nasdaq Biotechnology Index (consisting of a group of approximately 75 companies in the biotechnology sector) for purposes of the performance comparison that appears below.

The graph shows the cumulative total stockholder return assuming the investment of $100 and the reinvestment of dividends and is based on the returns of the component companies weighted according to their market capitalizations as of the end of each period for which returns are indicated. No dividends have been declared on our common stock. The graph commences as of November 29, 2000, the date our common stock first traded on the Nasdaq National Market. The stockholder return shown on the graph below is not necessarily indicative of future performance, and we do not make or endorse any predictions as to future stockholder returns.

Comparison of Quarterly Cumulative Total Return on Investment

15

Lombard Odier & Cie, Alta California Partners, L.P., Alta Embarcadero Partners, LLC, Frazier Healthcare II, L.P., Frazier and Company, Inc., Johnson and Johnson, Novartis and Thomas Volpe are entitled to certain rights with respect to registration under the Securities Act of shares of our common stock that they hold. These rights are provided under an Amended and Restated Investor Rights Agreement, dated February 3, 2000, and under agreements with similar registration rights. If we propose to register any of our securities under the Securities Act, either for our own account or for the account of others, these holders are entitled to notice of the registration and are entitled to include, at our expense, their shares of common stock in the registration and any related underwriting, provided, among other conditions, that the underwriters may limit the number of shares to be included in the registration. In addition, these holders may require us, at our expense and on not more than two occasions, to file a registration statement under the Securities Act with respect to their shares of common stock, and we will be required to use our best efforts to effect the registration. Further, these holders may require us, at our expense, to register their shares on Form S-3, subject to certain limitations. Pursuant to the terms of the Amended and Restated Investor Rights Agreement, in April 2002 we filed with the SEC a resale registration statement on Form S-3 to register 17,673,751 shares of common stock for resale.

We have entered into indemnification agreements with our directors and certain officers for the indemnification and advancement of expenses to these persons to the fullest extent permitted by law. We also intend to enter into those agreements with our future directors and officers.

In September 1999, we established a research collaboration and license agreement with Cell Genesys, Inc. James Gower, our Chairman and Chief Executive Officer, serves on the board of directors of Cell Genesys. Stephen A. Sherwin, MD, who serves on our board of directors, is Chief Executive Officer and Chairman of the Board of Cell Genesys.

We have an employment agreement with Dr. Payan, our Executive Vice President and Chief Scientific Officer, dated as of January 16, 1997, and continuing indefinitely. Under the agreement, Dr. Payan is entitled to receive an annualized base salary of $185,000 and was issued 750,000 shares of our common stock. As of January 16, 2000, all such shares were fully vested and not subject to a right of repurchase by us. Either Rigel or Dr. Payan may terminate his employment at any time for any reason. If we terminate Dr. Payan's employment without cause, he will receive a severance payment equal to one year's base salary.

In May 1999, we signed an agreement for the establishment of a broad collaboration with Novartis, whereby the two companies agreed to work on up to five different five-year research projects to identify drug targets for products that can treat, prevent or diagnose the effects of human disease. According to the terms of the original agreement, two of the research projects were to be conducted jointly by Novartis and us, and the other three research projects were to be conducted at Novartis. Four projects are now underway. The first research project, a joint research project, is focused on identifying small molecule drug targets that regulate T cells. The second research project, also a joint research project, relates to the identification and validation of small molecule drug targets that can mediate specific functions of B cells. The third research project, a project carried out at Novartis, is focused on identifying small molecule drug targets that regulate chronic bronchitis. In July 2001, Novartis and Rigel amended the agreement to add a three-year joint project at Rigel in the area of angiogenesis in lieu of a project at Novartis. In contrast to the original agreement to conduct an additional project at Novartis, this amendment resulted in both funded research at Rigel and an additional upfront payment to us of $4.0 million.

We believe that all of the transactions set forth above were made on terms no less favorable to us than could have been obtained from unaffiliated third parties. All future transactions, including loans, between us and our officers, directors, principal stockholders and their affiliates will be approved by a majority of our board of directors, including a majority of the independent and disinterested directors, and will be on terms no less favorable to us than could be obtained from unaffiliated third parties.

16

The board of directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

| |

|

|

|---|---|---|

| By Order of the Board of Directors | ||

|

||

| James H. Welch Secretary |

||

May 15, 2002 |

The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as "householding," potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are Rigel stockholders may be "householding" our proxy materials. A single proxy statement may be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be "householding" communications to your address, "householding" will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in "householding" and would prefer to receive a separate proxy statement and annual report, please notify your broker directly or direct your written request to: Secretary, Rigel Pharmaceuticals, Inc., 240 East Grand Avenue, South San Francisco, CA 94080 or contact Secretary, Rigel Pharmaceuticals, Inc. at (650) 624-1100. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request "householding" of their communications should contact their broker.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2001 is available without charge upon written request to: Investor Relations, Rigel Pharmaceuticals, Inc., 240 East Grand Avenue, South San Francisco, CA 94080.

17

RIGEL PHARMACEUTICALS, INC.

ANNUAL MEETING OF STOCKHOLDERS

THURSDAY, JUNE 20, 2002

10:00 A.M.

240 EAST GRAND AVENUE

SOUTH SAN FRANCISCO, CA 94080

|

RIGEL PHARMACEUTICALS, INC. |

|

|

|

240 EAST GRAND AVE. |

|

|

|

SOUTH SAN FRANCISCO, CA 94080 |

|

PROXY |

This proxy is solicited by the Board of Directors for use at the Annual Meeting on June 20, 2002.

The shares of stock you hold in your account or in a dividend reinvestment account will be voted as you specify on the reverse side.

If no choice is specified, the proxy will be voted “FOR” items 1 and 2.

By signing the proxy, you revoke all prior proxies and appoint Brian C. Cunningham and James H. Welch, and each of them, with full power of substitution, to vote your shares on the matters shown on the reverse side and any other matters that may come before our annual meeting and all adjournments.

See reverse for voting instructions.

COMPANY #

CONTROL #

There are three ways to vote your Proxy

Your telephone or Internet vote authorizes the Named Proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card.

VOTE BY PHONE—TOLL FREE—1-800-240-6326—QUICK—EASY—IMMEDIATE

· Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week, until 11:00 a.m. (CT) on June 19, 2002.

· You will be prompted to enter your 3-digit Company Number and your 7-digit Control Number, which are located above.

· Follow the simple instructions the voice provides you.

VOTE BY INTERNET—http://www.eproxy.com/rigl/—QUICK—EASY—IMMEDIATE

· Use the Internet to vote your proxy 24 hours a day, 7 days a week, until 12:00 p.m. (CT) on June 19, 2002.

· You will be prompted to enter your 3-digit Company Number and your 7-digit Control Number, which are located above to obtain your records and create an electronic ballot.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Rigel Pharmaceuticals, Inc., c/o Shareowner Services, P.O. Box 64873, St. Paul, MN 55164-0873.

If you vote by Phone or Internet, please do not mail your Proxy Card.

\*/ Please detach here \*/

The Board of Directors Recommends a Vote FOR Items 1 and 2.

|

1. |

Election of directors: |

01 Walter H. Moos, PhD |

03 Thomas S. Volpe |

o |

Vote FOR all nominees (except as marked) |

o |

Vote WITHHELD from all nominees |

|

|

|

02 Stephen A. Sherwin, MD |

|

|

|

|

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

|

|

|

|

2. |

|

Ratification of the selection of Ernst & Young LLP as the independent auditors of the company for its fiscal year ending December 31, 2002. |

|

o For |

o Against |

o Abstain |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR EACH PROPOSAL.

|

Address Change? Mark Box o |

Date: |

|

|

Indicate changes below: |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Signature(s) in Box |

|

|

|

Please sign exactly as your name(s) appears on the proxy. If held in joint tenancy, all persons must sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. |

|