UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

AMENDMENT NO. 1

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2002 |

|

or |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-29889

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

94-3248524 (IRS Employer Identification Number) |

|

1180 Veterans Blvd. South San Francisco, California (Address of principal executive offices) |

94080 (Zip Code) |

|

(650) 624-1100 (Registrant's telephone number, including area code) |

||

Securities registered pursuant to Section 12(b) of the Act: None |

||

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share (Title of Class) |

||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by a check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2) Yes ý No o

The approximate aggregate market value of the Common Stock held by non-affiliates of the registrant, based upon the closing price of the Common Stock as reported on the Nasdaq National Market on June 28, 2002, the last business day of the registrants most recently completed second fiscal quarter, was $100,285,535.

As of March 14, 2003, there were 45,976,828 shares of the registrant's Common Stock outstanding.

| |

|

Page |

||

|---|---|---|---|---|

| PART I | ||||

| Item 1. | Business | 1 | ||

| Item 2. | Properties | 25 | ||

| Item 3. | Legal Proceedings | 25 | ||

| Item 4. | Submission of Matters to a Vote of Security Holders | 25 | ||

PART II |

||||

| Item 5. | Market for the Registrant's Common Equity and Related Stockholder Matters | 26 | ||

| Item 6. | Selected Financial Data | 27 | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 28 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 37 | ||

| Item 8. | Financial Statements and Supplementary Data | 38 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 58 | ||

PART III |

||||

| Item 10. | Directors and Executive Officers of the Registrant | 59 | ||

| Item 11. | Executive Compensation | 62 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 65 | ||

| Item 13. | Certain Relationships and Related Transactions | 68 | ||

| Item 14. | Controls and Procedures | 69 | ||

PART IV |

||||

| Item 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 70 | ||

| Signatures | 73 | |||

| Certifications | 75 |

i

Statements made in this document other than statements of historical fact, including statements about Rigel's scientific programs, preclinical studies, product pipeline, corporate partnerships, licenses and intellectual property, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are subject to a number of uncertainties that could cause actual results to differ materially from the statements made, including risks associated with the success of research and product development programs, results achieved in future preclinical studies and clinical trials, the regulatory approval process, competitive technologies and products, the scope and validity of patents, proprietary technology and corporate partnerships. Reference is made to discussion about risks associated with product development programs, intellectual property and other risks that may affect our business under "Risk Factors" below. We do not undertake any obligation to update forward-looking statements.

Overview

Rigel's mission is to become a source of novel, small-molecule drugs to meet large, unmet medical needs. Our business model is to develop a portfolio of drug candidates and to take these through Phase II clinical trials, after which we intend to seek partners for completion of clinical trials, regulatory approval and marketing. We have identified three lead product development programs: mast cell inhibition to treat immunologic diseases such as asthma/allergy and autoimmune disorders, antiviral agents to treat hepatitis C, and ubiquitin ligases, a new class of cancer drug targets. We have begun clinical testing of our first product candidate, for the treatment of allergic rhinitis, and plan to begin clinical trials of two additional drug candidates for the treatment of hepatitis C and rheumatoid arthritis within the next twelve months. Our approach to drug discovery is based on advanced, proprietary functional genomics techniques that allow us to identify targets with a demonstrable role in a disease pathway and to screen efficiently for those targets that are likely to be amenable to drug modulation. We were incorporated in Delaware in June 1996, and we are based in South San Francisco, California.

Our Strategy

Our strategy is to develop a portfolio of drug candidates that can be developed into small molecule therapeutics. We believe that producing a portfolio of many drug candidates and working in conjunction with pharmaceutical companies to further develop those candidates increases our probability of commercial success. By utilizing our technology to rapidly discover and validate new targets and drug candidates in a wide range of applications, we believe that our portfolio approach allows us to minimize the risk of failure by pursuing many drug candidates at once, while concurrently being well positioned to help fill a continuing product pipeline gap of major pharmaceutical companies.

The drug development process is one that is subject to both high costs and high risk of failures. Rather than incur the costs of taking drug candidates all the way through the drug approval process and exposing ourselves to the risk of failure associated with Phase III clinical trials, we intend to identify a portfolio of new drug candidates across a broad range of diseases and develop them through Phase II clinical trials only. We believe that multiple drug candidates can be developed through Phase II clinical trials for approximately the same cost as would be required to take one drug candidate through Phase III clinical trials and marketing approval.

The key elements of our scientific and business strategy are to:

1

Proprietary Product Development

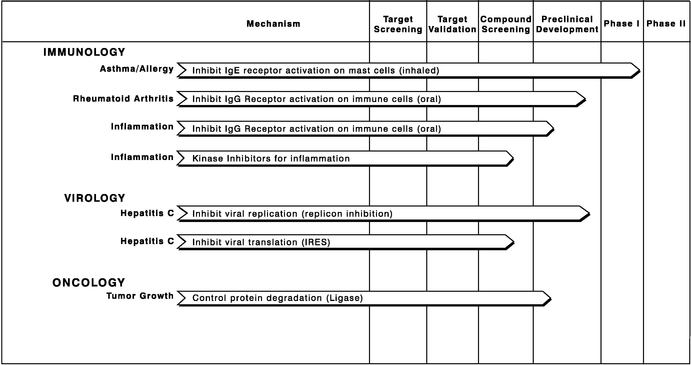

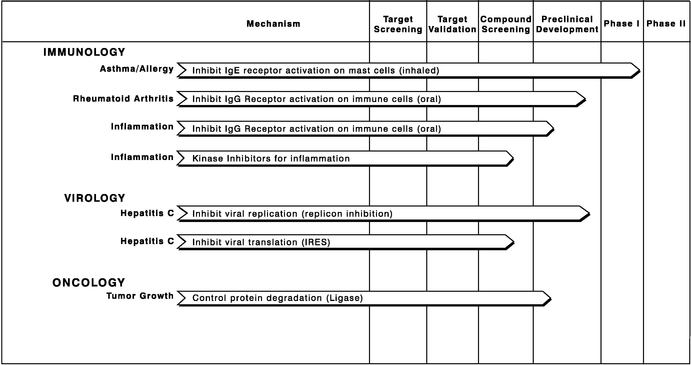

We conduct research programs for our own proprietary programs as well as for programs conducted jointly with our partners. Our proprietary programs are completely owned by us. The following table summarizes the key information for these proprietary programs that focus on specific disease mechanisms:

These Programs are:

2

Immunology

Many diseases and disorders result from defects in the immune system. Over 40 million people in the United States suffered from allergic disorders and over 20 million people suffered from asthmatic disorders in 2001. Anti-asthmatic and allergy relief medications exceeded $5 billion in worldwide sales in 2001. In 2001, another 3 million to 5 million patients in the United States were treated for other immune disorders. We currently have four programs in immunology focused on asthma/allergy, rheumatoid arthritis and inflammation.

Our mast cell kinase inhibitor program has produced a number of therapeutic opportunities. The goal of this program is to identify compounds that inhibit the secretion of inflammatory factors resulting from either IgE or IgG binding to receptors on mast cells. We believe that small molecule inhibitors of IgE or IgG signaling pathways could play an important role in the treatment of chronic immune disorders. In addition, we believe that our chemistry efforts may have identified additional kinase inhibitors that regulate other related processes within mast cells and other immune cells.

The first compound out of this program, R112, is an inhaled kinase inhibitor, and we expect that a number of additional therapeutic targets could emerge from this program.

Asthma/Allergy. We began a Phase I clinical trial of R112 in September 2002 in Britain. In this initial safety study, conducted with healthy volunteers, no significant adverse events were observed. The data from this trial was incorporated into an investigational new drug, or IND, application that was filed with the United States Food and Drug Administration, or FDA, in November 2002. Approval to proceed was received from the FDA in December 2002 and a clinical trial is now underway at National Jewish Medical Center in Denver, Colorado. The clinical trial will evaluate the effectiveness of R112 in patients with documented allergies. We expect to have the results of this study in the middle of 2003.

Rheumatoid Arthritis. Another drug candidate that we expect to emerge from our mast cell kinase inhibitor program is a compound that inhibits IgG receptor activation for therapeutic applications in the area of rheumatoid arthritis. We have administered several product candidates into animal models of rheumatoid arthritis. We expect to file an IND application with the FDA for the indication of rheumatoid arthritis by early 2004.

Inflammation. We are also researching in other autoimmune mediated inflammation disorders such as multiple sclerosis and inflammation of the bowel. We are in the process of conducting preclinical studies with our product candidates in animal models of multiple sclerosis and inflammation of the bowel.

Inflammation Using Other Targets. We have identified more than one kinase that may be inhibited in order to treat inflammation related disorders, and we are in the process of screening other compounds against various kinases in order to find additional lead compounds to potentially treat inflammation related disorders.

Virology

Experts estimate that over 170 million people worldwide are infected by the hepatitis C virus, with more than 4 million cases in the United States. Hepatitis C is a major cause of chronic hepatitis, cirrhosis and hepatocellular carcinoma. Approximately 85 percent of those who contract the disease remain chronically infected. Interferon-alpha, the current treatment standard, is ineffective in a significant portion of HCV-infected individuals, and an increasing number of patients are developing drug resistance.

Hepatits C Replicon Program. Our lead program in the hepatitis C area is a program with particular emphasis on developing a small-molecule drug candidate to block the ability of the virus to reproduce itself. This approach is substantially different from interferon-alpha, which primarily works

3

indirectly to boost the immune system. In contrast, our lead compound, R803, appears to target the virus directly by interfering with a viral protein involved in replication. R803 is currently in preclinical development, and we expect to initiate clinical trials in late 2003.

Hepatitis C IRES Program. We initiated a research program based upon technology acquired from Questcor Pharmaceuticals, Inc. in September 2000. The goal of this program is to identify compounds that interfere with the IRES translation mechanism of the hepatitis C virus. A set of high-throughput cell-based screens has been established, and initial compounds have been identified as part of this program. Under the terms of our agreement with Questcor, we are obligated to assign back to Questcor all of our rights in the technology and intellectual property to which we are entitled pursuant to the agreement if we commit a material breach of the agreement and if Questcor follows certain procedures set forth in the agreement.

Oncology

Cancer is a group of diseases characterized by the uncontrolled growth and proliferation of cells. This growth invades vital organs and often results in death. The United States market for branded cancer drugs totaled approximately $7.0 billion in 2001 and is projected to grow at an 11% annual growth rate. Cancer is the second leading cause of death in the United States, exceeded only by cardiovascular disease. In 2001, an estimated 1.3 million people were diagnosed with cancer, and more than 550,000 patients died of cancer in the United States. Although there have been improvements in cancer therapies over the last decade, there remains a significant medical need for the development of both more effective and less toxic drugs for the treatment of cancer.

Control Protein Degradation. This program is focused on characterizing and developing specific inhibitors of protein-degrading enzymes referred to as ubiquitin ligases. Many intracellular proteins that play a critical role in signaling pathways are regulated by the protein-degrading process. Many signaling proteins control cell function through active intermediates whose levels vary rapidly during different phases of a physiologic response. Disease processes can be treated by up-regulating or down-regulating these key signaling proteins as a way to enhance or dampen specific cellular responses. This antitumor program is focused on the ubiquitin ligase pathway unique to malignancies. The goal of this program is to use specific inhibitors of ubiquitin ligases that regulate mitosis, or cell division, to stop growth and induce apoptosis, or cell death, in transformed cancer cell lines. We have completed high-throughput screening, or HTS, and have identified several preclinical candidate compounds in this program. We are in the process of conducting preclinical studies.

Corporate Collaborations

We have established and will continue to pursue corporate collaborations with pharmaceutical and biotechnology companies to fund a wide array of research and development programs. We currently have collaborations with four major pharmaceutical companies, including one with Janssen Pharmaceutica N.V., a division of Johnson & Johnson, relating to oncology therapeutics and diagnostics, one with Pfizer Inc. relating to asthma and allergy therapeutics, one with Novartis Pharma AG with four different programs relating to immunology, oncology and chronic bronchitis and one with Daiichi Pharmaceuticals Co., Ltd. in the area of oncology.

As of December 31, 2002, we had received a total of $77.8 million from our collaborators. Included in this amount is $20.0 million from the private placement and public offering of equity securities and $57.8 million from the receipt of technology access fees, research funding and milestone payments, of which $6.2 million was deferred at December 31, 2002. In addition, we have a number of scientific collaborations with academic institutions and biotechnology companies under which we have in-licensed technology. We intend to pursue further collaborations as appropriate.

4

In most of our collaborations, inventions are intended to be owned by the employer of their inventors in accordance with United States patent law, subject to licenses or assignments granted in the agreements.

Johnson & Johnson

Effective December 1998, we entered into a three-year research collaboration, ended on December 4, 2001, with Johnson & Johnson, to identify, discover and validate novel drug targets that regulate cell cycle, and, specifically, to identify drug targets and the active peptides that bind to them that can restore a mutated cell's ability to stop uncontrolled cell division. In December 2001, Johnson & Johnson extended this research collaboration for an additional two years through December 2003. Under the agreement, we are providing certain assays and associated technology to Johnson & Johnson for the assessment of the alteration or normalization of the dysfunctional cell cycles of cancer cells for Johnson & Johnson's internal research purposes. Furthermore, in an amendment to the collaboration in July 2000, Johnson & Johnson expanded the collaboration whereby we performed compound screening and medicinal chemistry on some of the validated targets accepted by Johnson & Johnson. We have identified several novel drug targets in this program, four of which have been accepted by Johnson & Johnson as validated. Two of these four targets have completed HTS at Rigel and are being prepared for HTS at Johnson & Johnson.

Under the collaboration, Johnson & Johnson has the exclusive right to utilize our technology, and technology developed during the collaboration, to discover, develop, identify, make and commercialize certain products on a worldwide basis. These products are:

Johnson & Johnson also has a non-exclusive right to use our technology, and technology developed during the research collaboration, to the extent necessary to use the assays we transfer to Johnson & Johnson for internal research. Johnson & Johnson's rights are subject to its obligation to provide research funding for the collaboration, make milestone payments and technology access payments to us and pay royalties to us on the sales of products.

We will have the non-exclusive right to use any technology developed by Johnson & Johnson during the research collaboration, and any improvements to our technology developed by Johnson & Johnson during its internal research, on a royalty-free and worldwide basis.

In connection with the collaboration agreement, Johnson & Johnson Development Corporation purchased 1,500,000 shares of our Series D preferred stock at a price per share of $2.00 in connection with our Series D financing. Subsequently, Johnson & Johnson Development Corporation purchased 166,666 shares of our Series E preferred stock at a price per share of $6.00 in connection with our Series E financing. The 1,666,666 shares of preferred stock converted into 1,666,666 shares of common stock upon completion of our initial public offering in December 2000.

5

Pfizer

Effective January 1999, we entered into a research collaboration with Pfizer to identify and validate intracellular drug targets that control and inhibit the production of IgE in B Cells in the area of asthma/allergy. The research phase of the collaboration was initially scheduled to end on January 31, 2001. In January 2001, Pfizer notified us of its election to exercise its option to extend the funded research portion of the collaboration one additional year to January 31, 2002. During the research phase at Rigel, the collaboration was successful in identifying several intracellular drug targets that control the production of IgE, a key mediator in allergic reactions and asthma in B cells. Through the conclusion of the research phase of the collaboration, which was extended by one additional month to February 28, 2002, Pfizer accepted a total of seven validated targets. We believe that Pfizer has plans to move some of the validated targets forward through its drug discovery process. We have provided the following technology developed or identified during and pursuant to the research portion of the collaboration with Pfizer:

Pfizer will exclusively own drug targets for which it has initiated HTS. We will have no obligation to Pfizer with regard to any drug target Pfizer does not select for HTS.

We and Pfizer each have the non-exclusive right to use for research purposes the technology of the other that was disclosed or developed during the research collaboration, excluding our peptide libraries and proprietary cell lines. Under the collaboration, Pfizer also has the exclusive, worldwide right to develop and market diagnostic and therapeutic products for humans and animals that were identified by Pfizer in HTS and modulate the activity of a drug target identified in the research collaboration. Pfizer's rights to develop and market such products are subject to its obligation to continue to pay research milestones and subsequent royalties on the sales of these products.

At the initiation of the collaboration, Pfizer purchased 1,000,000 shares of our Series D preferred stock at a price per share of $2.00 in connection with our Series D financing, which converted into 1,000,000 shares of our common stock upon completion of our initial public offering in December 2000.

Novartis

In May 1999, we signed an agreement for the establishment of a broad collaboration with Novartis. We agreed to work with Novartis on up to five different five-year research projects to identify drug targets for products that can treat, prevent or diagnose the effects of human disease. Two of the research projects would be conducted jointly by Novartis and us, and the other three research projects were to be conducted at Novartis. The first research project, a joint research project, was focused on identifying small molecule drug targets that regulate T cells in the area of transplant rejection. The second research project, also a joint research project, related to the identification and validation of small molecule drug targets that mediate specific functions of B cells in the area of autoimmunity. During 2002, Novartis notified us that it was terminating the research phases of the initial T Cell and B Cell joint projects in November 2002 and February 2003, respectively. The third research project, a project currently being carried out at Novartis, is focused on identifying small molecule drug targets that regulate chronic bronchitis. Novartis may terminate this chronic bronchitis research at any time. In July 2001, we amended the agreement to add a three-year joint project at Rigel in the area of angiogenesis in lieu of a project at Novartis. This resulted in both funded research at Rigel and an additional upfront payment of $4.0 million, which were terms not previously included in the project at

6

Novartis. In January 2002, Novartis chose not to exercise its option to add a second project to be conducted at Novartis.

Once a drug target from any of the four ongoing research projects has been identified and validated, Novartis has the right to conduct compound screening on such drug target on an exclusive basis for two years thereafter. Novartis will have the option to extend this exclusive right for up to five additional one-year periods so long as Novartis pays us an annual fee for such right and satisfies certain diligence conditions. Upon the expiration or termination of this right, both we and Novartis shall have the non-exclusive right to use, and allow others to use, such drug target for compound screening.

Under the 1999 agreement, Novartis has the non-exclusive right to utilize our retroviral technology and pathway mapping technology for confirmational and similar uses relating to validated drug targets, including uses necessary for the further development, registration and commercialization of products for which the principal mechanism of action is based upon, derived or discovered from, or discovered with the use of, a drug target. Novartis also has the exclusive right to utilize other of our technology, and technology developed during the collaboration, to make and commercialize these products. Novartis' rights are subject to its obligation to provide research funding for the joint research projects, pay milestone payments and technology access payments to us and pay third-party royalties associated with Novartis' use of certain of our technology.

Under the agreement, we will have the non-exclusive right to use any improvements to our retroviral technology and pathway mapping technology developed during a research project on a royalty-free and worldwide basis.

Novartis purchased 2,000,000 shares of our Series D preferred stock at a per share purchase price of $2.00 in connection with our Series D financing and purchased 1,428,571 shares of our common stock in a private placement concurrent with the closing of our initial public offering at a price of $7.00 per share. The 2,000,000 shares of preferred stock converted into 2,000,000 shares of our common stock in conjunction with our initial public offering in December 2000.

Daiichi

In August 2002, we signed an agreement for the establishment of a collaboration with Daiichi to pursue research related to a specific protein degradation target. Per the agreement, the research phase of this collaboration is for three years. We will be working with Daiichi to discover and develop cancer pharmaceutical drugs. Under the terms of the collaboration agreement, Daiichi has paid us an upfront amount and a milestone payment, is obligated to pay us ongoing research support and may become obligated to pay us certain other milestones payments. In addition, we will receive royalties on any commercialized products to emerge from the collaboration.

The initial stages of the collaboration focused on the development of the assay for a specific target and the initiation of HTS to identify therapeutic molecules we and Daiichi would like to advance to later stages of drug development. Under terms of the agreement, we retain the rights to co-develop and co-promote products resulting from this collaboration in North America while Daiichi retains co-development and promotion rights in the remainder of the world.

Our Solution

The technologies that we use in connection with both our proprietary product development programs and our corporate collaborations are designed to identify protein targets for compound screening and validate the role of those targets in the disease process. Unlike genomics-based approaches, which begin by identifying genes and then search for their functions, our approach identifies proteins that are demonstrated to have an important role in a disease pathway. By understanding the disease pathway, we attempt to avoid studying genes that will not make good drug

7

targets and focus only on the sub-set of expressed proteins of genes that we believe are specifically implicated in the disease process.

We begin by developing assays that model the key events in a disease process at the cellular level. We then efficiently search hundreds of millions of cells to identify potential protein targets. In addition, we identify the proteins involved in the intracellular process and prepare a map of their interactions, thus giving us a comprehensive picture of the intracellular disease pathway. We believe that our approach has a number of advantages:

Because of the very large number of cells and proteins employed, our technology is labor intensive. The complexity of our technology requires a high degree of skill and diligence to perform successfully. In addition, successful application of our technology depends on a highly diverse collection of proteins to test in cells. We believe we have been able to and will continue to meet these challenges successfully. Although one or more other companies may utilize technologies similar to certain aspects of our technology, we are unaware of any other company that employs the same combination of technologies as we do.

Technology

Our retroviral and pathway mapping technologies enable us to identify and validate new protein targets and establish a map of the intracellular proteins that define a specific signaling pathway controlling cellular responses. We believe that, together, these technologies allow for rapid pathway mapping of complex biological processes and increase our ability to identify targets for drug discovery.

Retroviral Functional Screening. Our retroviral technology introduces up to 100 million different peptides, or proteins, into an equal number of normal or diseased cells. Each retrovirus delivers a specific gene into an individual cell, causing the cell to produce a specific protein. Then, we stimulate the cells in a manner known to produce a disease-like behavioral response or phenotype of the disease process. Once in the cell, the expressed protein interacts with potential protein targets in the cell. Then, we sort the cells at a rate of up to 60,000 cells/second to collect data on up to five different parameters, which means that a sort of 100 million cells can be completed in approximately half an hour. By analyzing the approximately 500 million resulting data points, we can rapidly identify those few cells containing an expressed protein that has interacted with a protein target in a way that causes the cell to change its behavior from diseased back to normal. Using this method, we believe that we can identify the relatively few targets that are validated in the context of a disease-specific cellular response.

8

Pathway Mapping. Our pathway mapping technology identifies specific proteins that bind with other proteins that are known to be part of a signaling pathway, either because we identified them using our retroviral technology or because the proteins have been described in the scientific literature. This pathway mapping technology is directed at:

Using our pathway mapping technology, we split a protein that gives a detectable signal (reporter protein), such as fluorescence, into two inactive parts. One part of the reporter protein is fused with a specific protein known to be involved in a signaling disease-relevant pathway (bait protein). Multiple copies of the other part of the reporter protein are fused one by one with all the proteins known to be present in the cell type being studied (library protein). When the bait protein binds to a specific library protein, the two parts of the reporter protein reunite and become active again, thereby generating a detectable signal. We employ an improved version of the two hybrid protein interaction method in yeast cells. In addition, we have developed a patented method of employing the two hybrid protein interaction technology in mammalian cells. Mammalian cells offer the opportunity to monitor protein-protein interactions in a potentially more relevant cellular environment.

We also use this pathway mapping technology to screen identified protein targets against a library of peptides in order to identify each active interaction site on the target. This information is useful in directing our chemistry efforts to identify compounds specifically designed to bind to the interaction site on the target.

Target Validation

The first step of our target validation occurs when we use our retroviral technology to identify targets. We design a screen that reflects a key event in a disease process so that when one of our proteins changes the behavior of a specific cell, this indicates a causal relationship between the protein-target interaction and the specific disease response. This approach saves time and enhances the probability that those targets that are identified and pursued are disease relevant. It also tells us that the protein interacts with a functional site on the target since the interaction results in a change in the behavior of the cell. We further validate the function of specific targets by:

Other Technologies

Our drug discovery technologies utilize the following additional technologies:

High-Throughput Compound Screening

Using our cell sorter system, we conduct screening of small molecule compounds in the same cell-based disease-specific screens that we use to identify the protein targets. This enables us to screen thousands of compounds in a matter of a few hours, while simultaneously examining multiple physiological parameters. In addition, we have established conventional high-throughput screens of small molecule compounds using biochemical methods similar to those widely used in the biotechnology

9

and pharmaceutical industries. We have a library of approximately 220,000 small molecule compounds having highly diverse molecular structures for our compound screening activities.

We select for compound screening only those protein drug targets we judge to meet several criteria:

Medicinal and Combinatorial Chemistries

Our medicinal chemistry group carries out traditional structure-activity relationship studies of potential lead compounds and makes improvements to those compounds by utilizing chemistry techniques to synthesize new analogs of a lead compound with improved properties. Our chemistry group synthesizes compounds incorporating desirable molecular features. We also utilize outside contract research organizations from time to time to supplement our internal chemistry resources.

Pharmacology and Preclinical Development

We believe that the rapid characterization and optimization of lead compounds identified in HTS will generate high-quality preclinical development candidates. Our pharmacology and preclinical development group facilitates lead optimization by characterizing lead compounds with respect to pharmacokinetics, potency, efficacy and selectivity. The generation of proof-of-principle data in animals and the establishment of standard pharmacological models with which to assess lead compounds represent integral components of lead optimization. As programs move through the lead optimization stage, our pharmacology and preclinical development group supports our chemists and biologists by performing the necessary studies, including toxicology, for IND application submissions.

Clinical Development

We have assembled a team of experts in drug development to design and implement clinical trials and to analyze the data derived from these studies. The clinical development group possesses expertise in project management and regulatory affairs.

Research and Development Expenses

Our research and development expenses were $43.4 million in 2002, $32.3 million in 2001 and $32.0 million in 2000.

Intellectual Property

We will be able to protect our technology from unauthorized use by third parties only to the extent that it is covered by valid and enforceable patents or is effectively maintained as trade secret. Accordingly, patents or other proprietary rights are an essential element of our business. We have over 100 pending patent applications and 23 issued patents in the United States which are owned or exclusively licensed in our field as well as pending corresponding foreign patent applications. Our policy is to file patent applications to protect technology, inventions and improvements to inventions that are commercially important to the development of our business. We seek United States and international patent protection for a variety of technologies, including new screening methodologies and other research tools, target molecules that are associated with disease states identified in our screens, and

10

lead compounds that can affect disease pathways. We also intend to seek patent protection or rely upon trade secret rights to protect other technologies that may be used to discover and validate targets and that may be used to identify and develop novel drugs. We seek protection, in part, through confidentiality and proprietary information agreements. We are a party to various other license agreements that give us rights to use technologies in our research and development.

In June 2002, we resolved a dispute with Inoxell A/S (formed as a spinout from Pharmexa—formally M&E Biotech) by entering into a global patent settlement concerning certain drug target identification technologies, which includes both cross-licensing and joint ownership to certain patents and allows for worldwide freedom of operation for both companies. Originally, Inoxell notified us that it had received patent protection in some European countries and Australia for a process that it asserted was similar to certain aspects of our technologies.

Competition

We face, and will continue to face, intense competition from pharmaceutical and biotechnology companies, as well as from academic and research institutions and government agencies, both in the United States and abroad. Some of these competitors are pursuing the development of pharmaceuticals that target the same diseases and conditions as our research programs. Our major competitors include fully integrated pharmaceutical companies that have extensive drug discovery efforts and are developing novel small molecule pharmaceuticals. We also face significant competition from organizations that are pursuing the same or similar technologies, including the discovery of targets that are useful in compound screening, as the technologies used by us in our drug discovery efforts. Our competitors or their collaborative partners may utilize discovery technologies and techniques or partner more rapidly or successfully than we or our collaborators are able to do.

Many of these companies and institutions, either alone or together with their collaborative partners, have substantially greater financial resources and larger research and development staffs than we do. In addition, many of these competitors, either alone or together with their collaborative partners, have significantly greater experience than we do in:

Accordingly, our competitors may succeed in obtaining patent protection, identifying or validating new targets or discovering new drug compounds before we do.

Competition may also arise from:

Developments by others may render our product candidates or technologies obsolete or noncompetitive. We face and will continue to face intense competition from other companies for collaborative arrangements with pharmaceutical and biotechnology companies, for establishing relationships with academic and research institutions and for licenses to additional technologies. These competitors, either alone or with their collaborative partners, may succeed in developing technologies or products that are more effective than ours.

11

Our ability to compete successfully will depend, in part, on our ability to:

Government Regulation

Our ongoing development activities are and will be subject to extensive regulation by numerous governmental authorities in the United States and other countries, including the FDA under the Federal Food, Drug and Cosmetic Act. The regulatory review and approval process is expensive and uncertain. Securing FDA approval requires the submission of extensive preclinical and clinical data and supporting information to the FDA for each indication to establish a product candidate's safety and efficacy. The approval process takes many years, requires the expenditure of substantial resources and may involve ongoing requirements for post-marketing studies. Clinical trials are subject to oversight by institutional review boards and the FDA and:

Even if we are able to achieve success in our clinical testing, we, or our collaborative partners, must provide the FDA and foreign regulatory authorities with clinical data that demonstrates the safety and efficacy of our products in humans before they can be approved for commercial sale. We began clinical trials in the United States in 2003, and we will not know whether these clinical trials will be successful or if such trials will be completed on schedule or at all. We also do not know whether any future clinical trials will demonstrate sufficient safety and efficacy necessary to obtain the requisite regulatory approvals or will result in marketable products. Our failure, or the failure of our strategic partners, to adequately demonstrate the safety and efficacy of our products under development will prevent receipt of FDA and similar foreign regulatory approval and, ultimately, commercialization of our products.

Any clinical trial may fail to produce results satisfactory to the FDA. Preclinical and clinical data can be interpreted in different ways, which could delay, limit or prevent regulatory approval. Negative or inconclusive results or adverse medical events during a clinical trial could cause a clinical trial to be repeated or a program to be terminated. In addition, delays or rejections may be encountered based upon additional government regulation from future legislation or administrative action or changes in FDA policy or interpretation during the period of product development, clinical trials and FDA regulatory review. Failure to comply with applicable FDA or other applicable regulatory requirements may result in criminal prosecution, civil penalties, recall or seizure of products, total or partial suspension of production or injunction, as well as other regulatory action against our potential

12

products, collaborative partners or us. Additionally, we have no experience in working with our partners in conducting and managing the clinical trials necessary to obtain regulatory approval.

Outside the United States, our ability to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical trials, marketing authorization, pricing and reimbursement vary widely from country to country. At present, foreign marketing authorizations are applied for at a national level, although within the European Union, or EU, registration procedures are available to companies wishing to market a product in more than one EU member state. If the regulatory authority is satisfied that adequate evidence of safety, quality and efficacy has been presented, a marketing authorization will be granted. This foreign regulatory approval process involves all of the risks associated with FDA clearance.

Employees

As of December 31, 2002, we had 160 employees. In January 2003, we announced a restructuring of our business, and, as a result, the number of employees was reduced to 135 on January 31, 2003.

Scientific Advisors

We utilize scientists and physicians to advise us on scientific and medical matters as part of our ongoing research and drug development efforts, including experts in human genetics, mouse genetics, molecular biology, biochemistry, cell biology, chemistry, infectious diseases, immunology and structural biology. Certain of our scientific and medical advisors and consultants receive an option to purchase our common stock and an honorarium for time spent assisting us.

Executive Officers of the Registrant

See "Item 10. Directors and Executive Officers of the Registrant" in Part III hereto.

Available Information

We maintain a site on the world wide web at www.rigel.com; however, information found on our website is not incorporated by reference into this report. We make available free of charge on or through our website our annual report of Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

In 2003, we intend to adopt a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We intend to post the text of our code of ethics on our website at www.rigel.com in connection with "Investor Resources" materials. In addition, we intend to promptly disclose (1) the nature of any amendment to our code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and (2) the nature of any waiver, including an implicit waiver, from a provision of our code of ethics that is granted to one of these specified officers, the name of such person who is granted the waiver and the date of the waiver on our website in the future.

13

Risk Factors

An investment in our securities is risky. Prior to making a decision about investing in our securities you should carefully consider the following risks, as well as the other information contained in this annual report on Form 10-K. If any of the following risks actually occurs, our business could be harmed. In that case, the trading price of our securities could decline, and you might lose all or part of your investment. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any of these additional risks or uncertainties occur, the trading price of our securities could decline, and you might lose all or part of your investment.

Our existing and committed capital resources are not sufficient to support our current operating plan beyond September 30, 2003, and we will need to obtain funding in order to continue operations beyond 2003.

We believe that our existing capital resources, together with anticipated payments under current collaborations, will be sufficient to support our current operating plan and spending through the end of September 2003. We will require additional financing to fund our operations as currently planned beyond that date. While we have been actively seeking both financing and corporate partnering opportunities, we cannot assure you that a sufficient financing or corporate partnering transaction can be completed on acceptable terms, or at all. If a sufficient financing or corporate partnering transaction cannot be completed or assured, we will not be able to continue our current operating plans and will be forced to reduce the scale of our operations. If a sufficient financing or corporate partnering transaction is not reasonably assured by the middle of May 2003, we will complete our R112 clinical trial currently under way and continue only with certain external preclinical studies in our Hepatitis C program. All other external studies would be terminated. If as of June 30, 2003 a sufficient financing or corporate partnering transaction is not reasonably assured, we will be required to significantly scale back our operations by reducing our headcount by approximately 50% and significantly reducing all discretionary spending. We anticipate that upon the execution of these actions, our existing capital resources will be sufficient to support the substantially reduced funding of our current programs as well as our operations through the end of 2003. To the extent we raise additional capital by issuing equity securities, our stockholders would at this time experience substantial dilution.

We will need additional capital in the future to sufficiently fund our operations and research.

Our operations will require significant additional funding in large part due to our research and development expenses, future preclinical and clinical-testing costs, the expansion of our facilities and the absence of any meaningful revenues for the foreseeable future. The amount of future funds needed will depend largely on the success of our collaborations and our research activities, and we do not know whether additional financing will be available when needed, or that, if available, we will obtain financing on terms favorable to our stockholders or us. We have consumed substantial amounts of capital to date, and operating expenditures are expected to increase over the next several years as we expand our infrastructure and research and development activities.

To the extent we raise additional capital by issuing equity securities, our stockholders would at this time experience substantial dilution. To the extent that we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish some rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us.

Our future funding requirements will depend on many uncertain factors.

Our future funding requirements will depend upon many factors, including, but not limited to:

14

Insufficient funds may require us to delay, scale back or eliminate some or all of our research or development programs, to lose rights under existing licenses or to relinquish greater or all rights to product candidates at an earlier stage of development or on less favorable terms than we would otherwise choose or may adversely affect our ability to operate as a going concern.

Our workforce reduction announced in January 2003 and any future workforce and expense reductions may have an adverse impact on our ability to make significant progress on our internal programs.

In January 2003, we announced a workforce reduction of approximately 25 employees in order to reduce expenses. In light of our continued need for funding, we may be required to implement further workforce and expense reductions this year. Workforce and expense reductions have resulted, and further reductions could result, in reduced progress on our internal programs. In addition, employees, whether or not directly affected by a reduction, may seek future employment with our business partners or competitors. Although our employees are required to sign a confidentiality agreement at the time of hire, the confidential nature of certain proprietary information may not be maintained in the course of any such future employment. Further, we believe that our future success will depend in large part upon our ability to attract and retain highly skilled personnel. We may have difficulty attracting such personnel as a result of a perceived risk of future workforce and expense reductions. In addition, the implementation of expense reduction programs may result in the diversion of efforts of our executive management team and other key employees, which could adversely affect our business.

Our success as a company is uncertain due to our limited operating history, our history of operating losses and the uncertainty of future profitability.

Due in large part to the significant research and development expenditures required to identify and validate new drug candidates and advance our programs into clinical testing, we have not been profitable and have generated operating losses since we were incorporated in June 1996. The extent of our future losses and the timing of potential profitability are highly uncertain, and we may never achieve profitable operations. We have incurred net losses of $37.0 million, $23.8 million and $25.3 million in each of the last three fiscal years, respectively. Currently, our revenues are generated

15

solely from research payments from our collaboration agreements and licenses and are insufficient to generate profitable operations. As of December 31, 2002, we had an accumulated deficit of approximately $114.8 million. Even if we are able to secure the financing necessary to continue our operations beyond 2003, we expect to incur losses for at least the next several years and expect that these losses will increase as we expand our research and development activities, incur significant clinical and testing costs and expand our facilities.

There is a high risk that early-stage drug discovery and development might not successfully generate good drug candidates.

At the present time, the majority of our operations are in the early stages of drug identification and development. To date only one of our drug compounds has made it into the clinical testing stage. In our industry, it is statistically unlikely that the limited number of compounds that we have identified as potential drug candidates will actually lead to successful drug development efforts, and we do not expect any drugs resulting from our research to be commercially available for several years, if at all. Our one product in the clinic and our future leads for potential drug compounds will be subject to the risks and failures inherent in the development of pharmaceutical products based on new technologies. These risks include, but are not limited to, the inherent difficulty in selecting the right drug target and avoiding unwanted side effects as well as the unanticipated problems relating to product development, testing, regulatory compliance, manufacturing, marketing, competition and costs and expenses that may exceed current estimates.

We might not be able to commercialize our drug candidates successfully if problems arise in the clinical testing and approval process.

Commercialization of our product candidates depends upon successful completion of preclinical studies and clinical trials. Preclinical testing and clinical development are long, expensive and uncertain processes. We do not know whether we, or any of our collaborative partners, will be permitted to undertake clinical trials of potential products beyond the one trial already concluded and the trial currently in process. It may take us or our collaborative partners several years to complete any such testing, and failure can occur at any stage of testing. Interim results of trials do not necessarily predict final results, and acceptable results in early trials may not be repeated in later trials. A number of companies in the pharmaceutical industry, including biotechnology companies, have suffered significant setbacks in advanced clinical trials, even after achieving promising results in earlier trials. Moreover, when our projects reach clinical trials, we or our collaborative partners may decide to discontinue development of any or all of these projects at any time for commercial, scientific or other reasons.

Delays in clinical testing could result in increased costs to us.

Significant delays in clinical testing could materially impact our product development costs. We do not know whether planned clinical trials will begin on time, will need to be revamped or will be completed on schedule, or at all. Clinical trials can be delayed for a variety of reasons, including delays in obtaining regulatory approval to commence a study, delays in reaching agreement on acceptable clinical study agreement terms with prospective clinical sites, delays in obtaining institutional review board approval to conduct a study at a prospective clinical site or delays in recruiting subjects to participate in a study.

In addition, we typically rely on third-party clinical investigators to conduct our clinical trials and other third-party organizations to oversee the operations of such trials and to perform data collection and analysis. As a result, we may face additional delaying factors outside our control if these parties do not perform their obligations in a timely fashion. While we have not yet experienced delays that have materially impacted our clinical trials or product development costs, delays of this sort could occur for the reasons identified above or other reasons. If we have delays in testing or approvals, our product

16

development costs will increase. For example, we may need to make additional payments to third-party investigators and organizations to retain their services or we may need to pay recruitment incentives. If the delays are significant, our financial results and the commercial prospects for our product candidates will be harmed, and our ability to become profitable will be delayed.

Because most of our expected future revenues are contingent upon collaborative and license agreements, we might not meet our strategic objectives.

Our ability to generate revenues in the near term depends on our ability to enter into additional collaborative agreements with third parties and to maintain the agreements we currently have in place. Our ability to enter into new collaborations and the revenue, if any, that may be recognized under these collaborations is highly uncertain. If we are unable to enter into new collaborations, our business prospects could be harmed, which could have an immediate adverse effect on the trading price of our stock.

To date, most of our revenues have been related to the research phase of each of our collaborative agreements. Such revenues are for specified periods, and the impact of such revenues on our results of operations is partially offset by corresponding research costs. Following the completion of the research phase of each collaborative agreement, additional revenue may come only from milestone payments and royalties, which may not be paid, if at all, until some time well into the future. The risk is heightened due to the fact that unsuccessful research efforts may preclude us from receiving any milestone payments under these agreements. Our receipt of revenue from collaborative arrangements is also significantly affected by the timing of efforts expended by us and our collaborators and the timing of lead compound identification. In late 2001, we recorded the first revenue from achievement of milestones in both the Pfizer and Johnson & Johnson collaborations. During 2002, we recorded our first milestone for both Novartis and Daiichi. Under many agreements, however, milestone payments may not be earned until the collaborator has advanced products into clinical testing, which may never occur or may not occur until some time well into the future. If we are not able to recognize revenue under our collaborations when and in accordance with our expectations or the expectations of industry analysts, this failure could harm our business and have an immediate adverse effect on the trading price of our stock.

Our business requires us to generate meaningful revenue from royalties and licensing agreements. To date, we have not received any revenue from royalties for the commercial sale of drugs, and we do not know when we will receive any such revenue, if at all. Likewise, we have not licensed any lead compounds or drug development candidates to third parties, and we do not know whether any such license will be entered into on acceptable terms in the future, if at all.

If our current corporate collaborations or license agreements are unsuccessful our research and development efforts could be delayed.

Our strategy depends upon the formation and sustainability of multiple collaborative arrangements and license agreements with third parties in the future. We rely on these arrangements for not only financial resources, but also for expertise that we expect to need in the future relating to clinical trials, manufacturing, sales and marketing, and for licenses to technology rights. To date, we have entered into several such arrangements with corporate collaborators; however, we do not know if such third parties will dedicate sufficient resources or if any development or commercialization efforts by third parties will be successful. Should a collaborative partner fail to develop or commercialize a compound or product to which it has rights from us, such failure might delay ongoing research and development efforts at Rigel because we might not receive any future milestone payments and we will not receive any royalties associated with such compound or product. In addition, the continuation of some of our partnered drug discovery and development programs may be dependent on the periodic renewal of our corporate collaborations. For example, the funded research phase of our collaboration with Pfizer has been

17

completed and the development portion of our collaboration is ongoing at Pfizer. In addition, in May 2002, Novartis elected to conclude the research phases of our two initial joint projects in the autoimmunity and transplant rejection areas, after 42 months, effective November 2002 and February 2003, respectively. Pursuant to the collaboration agreement, Novartis had the option to end the research phase on these programs after 24 months or 42 months. More generally, our current corporate collaboration agreements may terminate upon a breach or a change of control. We may not be able to renew these collaborations on acceptable terms, if at all, or negotiate additional corporate collaborations on acceptable terms, if at all.

Conflicts also might arise with collaborative partners concerning proprietary rights to particular compounds. While our existing collaborative agreements typically provide that we retain milestone payments and royalty rights with respect to drugs developed from certain derivative compounds, any such payments or royalty rights may be at reduced rates, and disputes may arise over the application of derivative payment provisions to such drugs, and we may not be successful in such disputes.

We are also a party to various license agreements that give us rights to use specified technologies in our research and development processes. The agreements pursuant to which we have in-licensed technology permit our licensors to terminate the agreements under certain circumstances If we are not able to continue to license these and future technologies on commercially reasonable terms, our product development and research may be delayed.

If conflicts arise between our collaborators or advisors and us, any of them may act in their self-interest, which may be adverse to your interests.

If conflicts arise between us and our corporate collaborators or scientific advisors, the other party may act in its self-interest and not in the interest of our stockholders. Some of our corporate collaborators are conducting multiple product development efforts within each disease area that is the subject of the collaboration with us. In some of our collaborations, we have agreed not to conduct, independently or with any third party, any research that is competitive with the research conducted under our collaborations. Our collaborators, however, may develop, either alone or with others, products in related fields that are competitive with the products or potential products that are the subject of these collaborations. Competing products, either developed by our collaborators or to which our collaborators have rights, may result in their withdrawal of support for our product candidates.

If any of our corporate collaborators were to breach or terminate its agreement with us or otherwise fail to conduct the collaborative activities successfully and in a timely manner, the preclinical or clinical development or commercialization of the affected product candidates or research programs could be delayed or terminated. We generally do not control the amount and timing of resources that our corporate collaborators devote to our programs or potential products. We do not know whether current or future collaborative partners, if any, might pursue alternative technologies or develop alternative products either on their own or in collaboration with others, including our competitors, as a means for developing treatments for the diseases targeted by collaborative arrangements with us.

If we fail to enter into new collaborative arrangements in the future, our business and operations would be negatively impacted.

Although we have established several collaborative arrangements and various license agreements, we do not know if we will be able to establish additional arrangements in the future. For example, there have been, and may continue to be, a significant number of recent business combinations among large pharmaceutical companies that have resulted, and may continue to result, in a reduced number of potential future corporate collaborators, which may limit our ability to find partners who will work with us in developing and commercializing our drug targets. We entered into only one collaboration, with Daiichi, in 2002. If business combinations involving our existing corporate collaborators were to occur,

18

the effect could be to diminish, terminate or cause delays in one or more of our corporate collaborations.

Our success is dependent on intellectual property rights held by us and third parties, and our interest in such rights is complex and uncertain.

Our success will depend to a large part on our own, our licensees' and our licensors' ability to obtain and defend patents for each party's respective technologies and the compounds and other products, if any, resulting from the application of such technologies. We have over 100 pending patent applications and 23 issued patents in the United States that are owned or exclusively licensed in our field as well as pending corresponding foreign patent applications. In the future, our patent position might be highly uncertain and involve complex legal and factual questions. Additional uncertainty may result from because no consistent policy regarding the breadth of legal claims allowed in biotechnology patents has emerged to date. Accordingly, we cannot predict the breadth of claims allowed in our or other companies' patents.

Because the degree of future protection for our proprietary rights is uncertain, we cannot ensure that:

We rely on trade secrets to protect technology where we believe patent protection is not appropriate or obtainable. However, trade secrets are difficult to protect. While we require employees, collaborators and consultants to enter into confidentiality agreements, we may not be able to adequately protect our trade secrets or other proprietary information in the event of any unauthorized use or disclosure or the lawful development by others of such information.

We are a party to certain in-license agreements that are important to our business, and we generally do not control the prosecution of in-licensed technology. Accordingly, we are unable to exercise the same degree of control over this intellectual property as we exercise over our internally-developed technology. Moreover, some of our academic institution licensors, research collaborators and scientific advisors have rights to publish data and information in which we have rights. If we cannot maintain the confidentiality of our technology and other confidential information in connection with our collaborations, then our ability to receive patent protection or protect our proprietary information will be impaired. In addition, some of the technology we have licensed relies on patented inventions developed using U.S. government resources. The U.S. government retains certain rights, as defined by law, in such patents, and may choose to exercise such rights.

19

If a dispute arises regarding the infringement or misappropriation of the proprietary rights of others, such dispute could be costly and result in delays in our research and development activities.

Our success will also depend, in part, on our ability to operate without infringing or misappropriating the proprietary rights of others. There are many issued patents and patent applications filed by third parties relating to products or processes that are similar or identical to ours or our licensors, and others may be filed in the future. There can be no assurance that our activities, or those of our licensors, will not infringe patents owned by others. For example, in June 2002, we resolved a dispute with Inoxell A/S (formed as a spinout from Pharmexa—formally M&E Biotech) by entering into a global patent settlement concerning certain drug target identification technologies, which includes both cross-licensing and joint ownership to certain patents and allows for worldwide freedom of operation for both companies. We believe that there may be significant litigation in the industry regarding patent and other intellectual property rights, and we do not know if we or our collaborators would be successful in any such litigation. Any legal action against our collaborators or us claiming damages or seeking to enjoin commercial activities relating to the affected products, our methods or processes could:

If we are unable to obtain regulatory approval to market products in the United States and foreign jurisdictions, we might not be permitted to commercialize products from our research and development.

Due, in part, to the early stage of our drug candidate research and development process, we cannot predict whether regulatory clearance will be obtained for any product that we, or our collaborative partners, hope to develop. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. Of particular significance to us are the requirements covering research and development and testing.

Before commencing clinical trials in humans in the United States, we, or our collaborative partners, will need to submit and receive approval from the FDA of an IND. Clinical trials are subject to oversight by institutional review boards and the FDA and:

20

While we have stated that we intend to file additional INDs, this is only a statement of intent, and we may not be able to do so because we may not be able to identify potential product candidates. In addition, the FDA may not approve any IND in a timely manner, or at all.

Before receiving FDA clearance to market a product, we must demonstrate that the product is safe and effective on the patient population that will be treated. Data obtained from preclinical and clinical activities are susceptible to varying interpretations that could delay, limit or prevent regulatory clearances. In addition, delays or rejections may be encountered based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials and FDA regulatory review. Failure to comply with applicable FDA or other applicable regulatory requirements may result in criminal prosecution, civil penalties, recall or seizure of products, total or partial suspension of production or injunction, as well as other regulatory action against our potential products or us. Additionally, we have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approval.

If regulatory clearance of a product is granted, this clearance will be limited to those disease states and conditions for which the product is demonstrated through clinical trials to be safe and efficacious. We cannot ensure that any compound developed by us, alone or with others, will prove to be safe and efficacious in clinical trials and will meet all of the applicable regulatory requirements needed to receive marketing clearance.

Outside the United States, our ability, or that of our collaborative partners, to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. This foreign regulatory approval process typically includes all of the risks associated with FDA clearance described above and may also include additional risks.

If our competitors develop technologies that are more effective than ours, our commercial opportunity will be reduced or eliminated.

The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. Many of the drugs that we are attempting to discover will be competing with existing therapies. In addition, a number of companies are pursuing the development of pharmaceuticals that target the same diseases and conditions that we are targeting. We face competition from pharmaceutical and biotechnology companies both in the United States and abroad.

Our competitors may utilize discovery technologies and techniques or partner with collaborators in order to develop products more rapidly or successfully than we, or our collaborators, are able to do. Many of our competitors, particularly large pharmaceutical companies, have substantially greater financial, technical and human resources than we do. In addition, academic institutions, government agencies and other public and private organizations conducting research may seek patent protection with respect to potentially competitive products or technologies and may establish exclusive collaborative or licensing relationships with our competitors.

We believe that our ability to compete is dependent, in part, upon our ability to create, maintain and license scientifically-advanced technology and upon our and our strategic partners' ability to develop and commercialize pharmaceutical products based on this technology, as well as our ability to attract and retain qualified personnel, obtain patent protection or otherwise develop proprietary technology or processes and secure sufficient capital resources for the expected substantial time period between technological conception and commercial sales of products based upon our technology. The failure by us or any of our collaborators in any of those areas may prevent the successful commercialization of our potential drug targets.

Our competitors might develop technologies and drugs that are more effective or less costly than any that are being developed by us or that would render our technology and potential drugs obsolete

21

and noncompetitive. In addition, our competitors may succeed in obtaining the approval of the FDA or other regulatory agencies for drug candidates more rapidly. Companies that complete clinical trials, obtain required regulatory agency approvals and commence commercial sale of their drugs before their competitors may achieve a significant competitive advantage, including certain patent and FDA marketing exclusivity rights that would delay or prevent our ability to market certain products. Any drugs resulting from our research and development efforts, or from our joint efforts with our existing or future collaborative partners, might not be able to compete successfully with competitors' existing or future products or products under development or obtain regulatory approval in the United States or elsewhere.

Our ability to generate revenues will be diminished if our collaborative partners fail to obtain acceptable prices or an adequate level of reimbursement for products from third-party payors.

The drugs we hope to develop may be rejected by the marketplace due to many factors, including cost. Our ability to commercially exploit a drug may be limited due to the continuing efforts of government and third-party payors to contain or reduce the costs of health care through various means. For example, in some foreign markets, pricing and profitability of prescription pharmaceuticals are subject to government control. In the United States, we expect that there will continue to be a number of federal and state proposals to implement similar government control. In addition, increasing emphasis on managed care in the United States will likely continue to put pressure on the pricing of pharmaceutical products. Cost control initiatives could decrease the price that any of our collaborators would receive for any products in the future. Further, cost control initiatives could adversely affect our collaborators' ability to commercialize our products and our ability to realize royalties from this commercialization.

Our ability to commercialize pharmaceutical products with collaborators may depend, in part, on the extent to which reimbursement for the products will be available from:

Significant uncertainty exists as to the reimbursement status of newly-approved healthcare products. Third-party payors, including Medicare, are challenging the prices charged for medical products and services. Government and other third-party payors increasingly are attempting to contain healthcare costs by limiting both coverage and the level of reimbursement for new drugs and by refusing, in some cases, to provide coverage for uses of approved products for disease indications for which the FDA has not granted labeling approval. Third-party insurance coverage may not be available to patients for any products we discover and develop, alone or with collaborators. If government and other third-party payors do not provide adequate coverage and reimbursement levels for our products, the market acceptance of these products may be reduced.

If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit commercialization of our products.

The testing and marketing of medical products entail an inherent risk of product liability. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our products. We currently do not have product liability insurance, and our inability to obtain sufficient product liability insurance at an acceptable cost to protect against potential product liability claims could prevent or inhibit the commercialization of pharmaceutical products we develop, alone or with corporate collaborators. We, or our corporate collaborators, might not be able to obtain insurance at a reasonable cost, if at all. While under various

22

circumstances we are entitled to be indemnified against losses by our corporate collaborators, indemnification may not be available or adequate should any claim arise.

Our research and development efforts will be seriously jeopardized, if we are unable to attract and retain key employees and relationships.

As a small company with only 135 employees as of January 31, 2003, our success depends on the continued contributions of our principal management and scientific personnel and on our ability to develop and maintain important relationships with leading academic institutions, scientists and companies in the face of intense competition for such personnel. In particular, our research programs depend on our ability to attract and retain highly skilled chemists, other scientists, and regulatory and clinical personnel. If we lose the services of any of our personnel, our research and development efforts could be seriously and adversely affected. Our employees can terminate their employment with us at any time.

We depend on various scientific consultants and advisors for the success and continuation of our research efforts.