UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | |

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2004 |

|

or |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-29889

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

94-3248524 (IRS Employer Identification Number) |

|

1180 Veterans Blvd. South San Francisco, California (Address of principal executive offices) |

94080 (Zip Code) |

|

(650) 624-1100 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share (Title of Class) |

||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by a check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2) Yes ý No o

The approximate aggregate market value of the Common Stock held by non-affiliates of the registrant, based upon the closing price of the registrant's Common Stock as reported on the Nasdaq National Market on June 30, 2004, the last business day of the registrant's most recently completed second fiscal quarter, was $175,394,000. Shares of the registrant's outstanding Common Stock held by each executive officer, director and holder of 5% or more of the registrant's outstanding Common Stock have been excluded. The determination of affiliate status for the purposes of this calculation is not necessarily a conclusive determination for other purposes.

As of February 28, 2005, there were 19,670,283 shares of the registrant's Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III incorporate information by reference from the definitive proxy statement for the Registrant's Annual Meeting of Stockholders to be held on June 2, 2005.

| |

|

Page |

|||

|---|---|---|---|---|---|

| PART I | |||||

Item 1. |

Business |

1 |

|||

Item 2. |

Properties |

24 |

|||

Item 3. |

Legal Proceedings |

24 |

|||

Item 4. |

Submission of Matters to a Vote of Security Holders |

24 |

|||

PART II |

|||||

Item 5. |

Market for the Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

25 |

|||

Item 6. |

Selected Financial Data |

26 |

|||

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

27 |

|||

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

36 |

|||

Item 8. |

Financial Statements and Supplementary Data |

37 |

|||

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

60 |

|||

Item 9A. |

Controls and Procedures |

60 |

|||

Item 9B. |

Other Information |

61 |

|||

PART III |

|||||

Item 10. |

Directors and Executive Officers of the Registrant |

62 |

|||

Item 11. |

Executive Compensation |

62 |

|||

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

62 |

|||

Item 13. |

Certain Relationships and Related Transactions |

62 |

|||

Item 14. |

Principal Accounting Fees and Services |

62 |

|||

PART IV |

|||||

Item 15. |

Exhibits, Financial Statement Schedules |

63 |

|||

Signatures |

66 |

||||

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K, including the documents that we incorporate by reference, contains statements indicating expectations about future performance and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. We usually use words such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "future," "intend," "potential" or "continue" or the negative of these terms or similar expressions to identify these forward-looking statements. These statements appear throughout this annual report on Form 10-K and are statements regarding our current intent, belief or expectation, primarily with respect to our operations and related industry developments. Examples of these statements include, but are not limited to, statements regarding the following: our business and scientific strategies; the progress of our product development programs, including clinical testing; our corporate collaborations, including revenues received from these collaborations; our drug discovery technologies; our research and development expenses; protection of our intellectual property; sufficiency of our cash resources; and our operations and legal risks. You should not place undue reliance on these forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward- looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Overview

Rigel Pharmaceuticals, Inc. was incorporated in Delaware in June 1996, and is based in South San Francisco. We discover and develop novel, small-molecule compounds for the treatment of large, unmet medical needs. Our objective is to create a portfolio of product candidates that we will develop for our own proprietary programs and with potential collaborative partners. Our productive discovery engine enables us to move one product candidate into the clinic each year. Currently, we have product development programs for the indications of allergy/asthma, rheumatoid arthritis, cancer, and hepatitis C.

Within the last year, we:

1

Our Strategy

Our objective is to create a portfolio of product candidates that can be developed into small molecule therapeutics for our own proprietary programs and with potential collaborative partners. We believe that producing a portfolio of many product candidates and working in conjunction with pharmaceutical companies increases our probability of development and commercial success. The product development process is one that is subject to both high costs and high risk of failure. We believe that this approach helps minimize the risk of failure, while concurrently strategically placing us in a position to help fill the continuing product pipeline gap at major pharmaceutical companies.

The key elements to our scientific and business strategy are to:

Our discovery engine is based on advanced, proprietary techniques that allow us to identify targets with a demonstrable role in a disease pathway and to screen efficiently for those targets that are likely to be amenable to drug modulation. With this approach, we can generate a portfolio of potential product candidates.

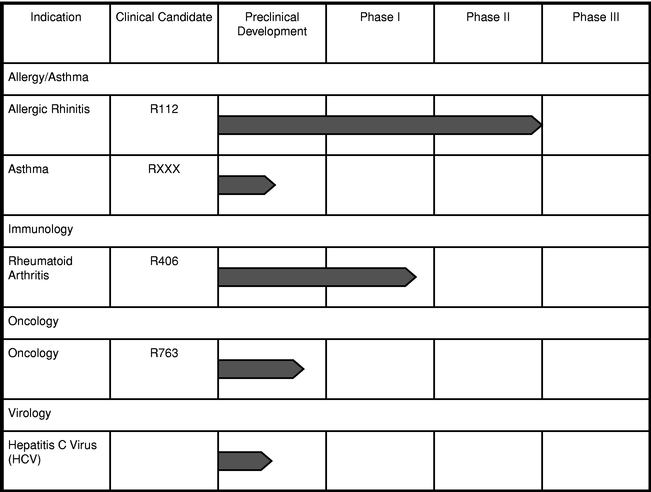

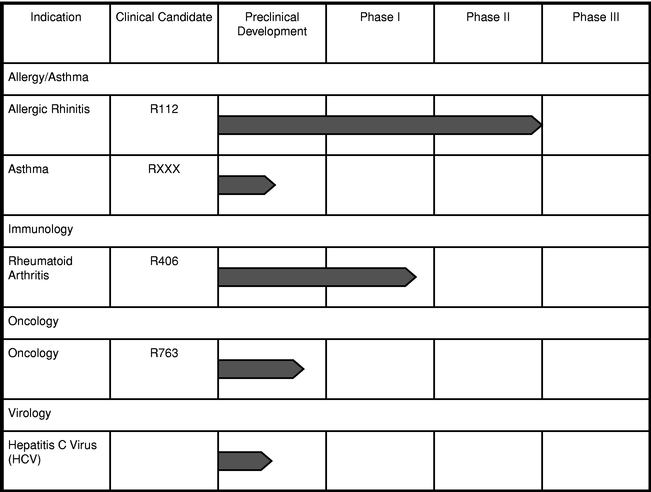

Clinical and Preclinical Product Development Programs

We conduct research and development programs for our product candidates. All of the following programs are owned entirely by us with the exception of our Asthma program, which we licensed to Pfizer in January 2005. We are currently developing several proprietary product candidates. Our most

2

advanced development efforts are described below. The following table summarizes the current status of our proprietary clinical development programs by potential therapeutic indication:

Allergy/Asthma

Disease background. Allergic rhinitis and asthma are chronic inflammatory disorders of the airways. Allergic rhinitis, or allergy, is an acute inflammatory reaction in the upper respiratory tract resulting in nasal congestion, sneezing, itching and watery eyes. Asthma affects the lower respiratory tract and is marked by episodic flare-ups, or attacks, that can be life threatening. In some patients, allergens, such as pollen, trigger the production of immunoglobulin E antibodies, or IgE antibodies, which then bind to mast cells and cause an intracellular signal that results in the release of various chemical mediators. When this process occurs repeatedly over time, it creates persistent inflammation of the airway passages, resulting in the chronic congestion and airway obstruction associated with allergic rhinitis and asthma, respectively. Over 59 million people in the United States suffer from allergic disorders, and over 11 million people suffer from asthmatic disorders.

3

Allergic rhinitis program. R112, our clinical candidate for allergic rhinitis, is an intranasal inhibitor of Syk, or spleen tyrosine kinase, a novel drug target for respiratory diseases such as allergic rhinitis and asthma. Syk is involved in IgE signaling in mast cells. Mast cells play important roles in both early and late phase allergic reactions, and Syk inhibitors could prevent both phases. We completed a Phase I clinical trial of R112 in December 2002 and a single-dose Phase I/II clinical trial in June 2003 that showed R112 was well tolerated and demonstrated physiological responses, including significant statistical improvement or consistent positive trends in reducing the release of chemical mediators involved in mast cell activation, one of the earliest steps in the initiation of an inflammatory response in allergy and asthma. A multi-dose safety trial completed in December 2003 indicated that R112 is well tolerated and demonstrates a favorable safety profile in the study population.

We completed a Phase II "park study" clinical trial of R112 in August 2004. This randomized, placebo-controlled Phase II "park study" enrolled 319 patients with the primary objective of measuring the safety and efficacy of R112 as an intranasal treatment for allergic rhinitis. The "park study" results demonstrated that R112 can reduce certain symptoms of allergic rhinitis in a statistically significant manner compared to placebo, has a favorable safety profile, and an onset of action of approximately thirty minutes. There were no significant drug-related adverse events reported in the trial, and adverse event frequencies were indistinguishable from placebo. As early as the 30-minute time interval after dosing, R112 showed a statistically significant improvement in symptom scores over placebo, demonstrating a rapid onset of action in symptom improvement. Furthermore, these beneficial effects lasted throughout the entire measurement period until the end of the park day. In particular, symptoms most closely associated with chronic nasal congestion (e.g. stuffy nose) were dramatically improved with R112 over placebo.

Based on the results of the single and multi-dose trials as well as the Phase II "park study", we plan to move R112 forward in clinical development with an additional Phase II study expected. We expect this study to be completed later in 2005. We are also actively seeking to partner with a pharmaceutical company with respect to R112. Under terms of an agreement with Pfizer Inc., Pfizer has a limited right of negotiation for R112 under certain circumstances, but the agreement does not preclude us from partnering with other pharmaceutical companies with respect to R112.

Asthma program. In the first quarter of 2005, we announced that we entered into a collaborative research and license agreement with Pfizer for the development of inhaled products for the treatment of allergic asthma and other respiratory diseases, such as COPD. The collaboration is focused on our preclinical small molecule compounds, which inhibit IgE receptor signaling in respiratory tract mast cells by blocking the signaling enzyme Syk kinase.

We expect Pfizer to advance a compound to the clinic combining their dry powder inhaler, their drug development capabilities and our novel small molecules. The first significant milestone under this collaboration is Pfizer's selection of a specific molecule to take into drug development.

Rheumatoid Arthritis

Disease background. Rheumatoid arthritis, or RA, is a chronic inflammatory disease that affects multiple tissues, but typically produces its most pronounced symptoms in the joints. It is often progressive and debilitating, preventing people from living a symptom-free life. Ultimately the chronic inflammation of joints leads to the destruction of the soft tissue and erosion of the articular surfaces of the bone. The disease is estimated to affect nearly 2.1 million people in the United States.

The current treatment options for RA have significant potential side effects and other shortfalls, including gastrointestinal complications and kidney damage. RA patients receive multiple drugs depending on the extent and aggressiveness of the disease. Most RA patients eventually require some form of disease modifying anti-rheumatic drug or DMARD. DMARD's include methotrexate, an

4

anti-cancer agent and Enbrel®, a TNF-blocking agent. TNF-blocking agents inhibit the inflammatory mediator, TNF, and are all delivered via injection.

Rheumatoid arthritis program. We intend to focus our RA program towards the development of an oral, safe DMARD that can be used earlier in the course of the disease, preventing its progression prior to major bone and cartilage destruction. We have selected R406 as our lead product candidate for initial clinical trials in RA. R406 is a novel, oral syk kinase inhibitor that, in preclinical studies, blocks the activation of mast cells and B cells that promote the swelling and inflammatory response. Data from preclinical studies indicate that R406 is effective in a rodent arthritis model, and was without significant toxicity at doses well above the effective dose. We initiated a Phase I clinical trial of R406 in December 2004. The goal of this trial is to establish the safety and pharmacokinetics of R406. The escalating single-dose, placebo-controlled clinical human safety trial included 35 volunteers and is being followed by a multiple-dose study including an additional 24 people. Results of the trial are expected within the next few months and, if favorable, will, allow us to enter broader, longer-term safety and efficacy trials in patients suffering from rheumatoid arthritis.

Oncology

Disease background. Cancer is the second leading cause of death in the United States. More than one million people get cancer each year, and nearly half of all men and a little over one-third of all women in the United States will develop cancer during their lifetimes. Anyone can get cancer at any age, however, approximately 77% of all cancers are diagnosed in people age 55 and older. Although cancer occurs in all racial and ethnic groups, the rate of incidence varies from group to group.

Aurora Kinase program. Aurora kinase plays a central role in the cell division process and the overexpression of aurora kinase can cause cells to quickly form an abnormal number of chromosomes. As such, aurora kinase is frequently associated with various solid tumor human cancers such as cancers of the breast, bladder, colon, ovary, head and neck, and pancreas. Increased knowledge of aurora kinase and its regulation potential may be the basis for treating and even preventing cancer.

R763 is a potent, highly-selective, small-molecule inhibitor of aurora kinase. In July 2004, we identified R763 as a lead compound in our aurora kinase inhibition program, targeting cancer cell proliferation. We intend to file an IND in 2005.

Hepatitis C Virus

Disease background. Hepatitis C is an inflammation of the liver caused by the hepatitis C virus. As the most common chronic blood-borne infection in the United States, the hepatitis C virus, or HCV, affects an estimated 3.9 million people in the United States and 170 million individuals worldwide. Approximately 80% of those with an acute illness will develop chronic hepatitis, a condition that has been linked to cirrhosis, liver failure and hepatocellular carcinoma, or liver cancer. HCV is a leading cause of chronic liver disease and is the most common indication for liver transplantation.

Currently available HCV therapies are only modestly effective at treating the disease. The most prevalent treatment regimen is with interferon alpha, or IFN, or its longer lasting pegylated version, usually in combination with ribavarin. IFN therapy works to boost the body's own immune system and generally requires six to 12 months of therapy to be effective. Only 20% to approximately 40% of the patients who complete IFN therapy have a successful response. IFN dosage must be reduced in 10% to 40% of patients and discontinued in 5% to 15% of patients because of severe side effects. Moreover, IFN is least effective against HCV genotype 1, the strain responsible for approximately 70% of chronic HCV cases in the United States.

Anti-HCV program. Our lead program addressing HCV has identified various compounds that are oral small molecules that work directly, rapidly and selectively on the virus by interfering with a viral

5

polymerase protein that is needed for replication. The first of these product candidates to enter the clinic was R803 with the completion of a Phase I/II study and announcement of the results in November 2004. Based on the clinical trial results of this study, we made the decision not to move forward with R803. However, we are aggressively examining alternative compounds for selection of a candidate to move forward into the clinic. Upon completion of this evaluation, we will be able to articulate our future course of action. We expect to reach a determination as to whether any of these alternative compounds meets our criteria by the middle of 2005.

Research Programs

We are conducting proprietary research in three broad disease areas: immunology/inflammation, virology and oncology. With each disease area we are conducting basic research as well as screening compounds against potential novel intracellular targets and optimizing those leads that appear most promising.

Currently, we are researching autoimmune mediated inflammation disorders such as transplant rejection, multiple sclerosis and inflammation of the bowel. We have identified more than one kinase that may be inhibited in order to treat inflammation related disorders, and we are in the process of screening other compounds against various kinases in order to find additional lead compounds to potentially treat inflammation related disorders. In the area of virology, we are investigating other potential targets to inhibit HCV replication. In addition, we are conducting initial screening tests of potential product candidates against other viruses. In the area of oncology, we are focused on inhibiting kinases as well as ligases (see below), a new target class that also may yield possible drug targets in immunology and virology as well.

Ubiquitin ligase program. Ubiquitin ligases are enzymes that regulate protein degradation within the cell. The breakdown of proteins, in turn, affects many important cellular functions, including cell division. Targeting ligases represents a novel approach to treating diseases where normal cellular processes are out of balance. Because unchecked cell division is the hallmark of cancer, researchers believe that this part of the cell machinery represents a particularly compelling target for cancer therapies. Ubiquitin ligase targets are numerous and modular. This provides the potential for intervening in a highly specific fashion with respect to a disease, potentially improving efficacy and minimizing side-effects.

We believe we are a leader in investigating and characterizing the ubiquitin ligase system for the discovery and development of potential new therapeutics in the oncology as well as immunology and virology areas. We have initiated one of the industry's broadest efforts with respect to ubiquitin ligase, working on the development of numerous ligase targets, and were one of the first companies to discover potent and highly selective small molecule inhibitors of ubiquitin ligases. Some of these inhibitors have shown positive activity in animal models of disease and are part of our preclinical development program.

In November 2004, we entered into a broad collaboration agreement with Merck and Co., Inc. to investigate ubiquitin ligases to find treatments for cancer and potentially other diseases. The collaboration is based on a number of new targets designated by Merck and do not include our current ligase targets. However, we may nominate our own targets for potential inclusion in the collaboration. We also have an ongoing program with Daiichi to pursue research related to ubiquitin ligases.

Corporate Collaborations

Current Collaborations

In addition to the preceding programs, we also carry on research and development programs in connection with our corporate collaborations. With the exception of our asthma program, for which we

6

recently partnered with Pfizer, we retain economic and commercial rights for all of the clinical and preclinical product development programs described above. We currently have collaborations with five major pharmaceutical companies, including one with Janssen Pharmaceutica N.V., a division of Johnson & Johnson, relating to oncology therapeutics and diagnostics, two with Pfizer relating to programs in asthma and allergy therapeutics, one with Novartis Pharma AG regarding four different programs relating to immunology, oncology and chronic bronchitis, one with Daiichi Pharmaceuticals Co., Ltd. in the area of oncology, and one with Merck to investigate ubiquitin ligases with the goal of finding treatments for cancer and potentially other diseases. These collaborations all have or had a research phase during which we receive or received funding based on the level of headcount allocated to a program. In all of our collaborations, after the research phase concludes and if certain conditions are met, we are entitled to receive future milestone payments and royalties. Only the Daiichi and Merck programs are currently in the research phase of their respective agreements and provide for regular research reimbursement payments.

Daiichi

In August 2002, we entered into an agreement with Daiichi to pursue research related to ligases, a novel class of drug targets that control cancer cell proliferation through protein degradation. Through this collaboration, we are working with Daiichi to discover and develop cancer pharmaceutical drugs. The initial stages of the Daiichi collaboration focused on the development of the assay for the specific target and the initiation of high-throughput compound screening to identify therapeutic molecules we and Daiichi would like to advance to later stages of product development. Under terms of the agreement, we retain the rights to co-develop and co-promote products resulting from this collaboration in North America while Daiichi retains co-development and promotion rights in the remainder of the world. Per the agreement, the research phase of this collaboration is set to expire in August 2005. Prior to the expiration of the research phase, Daiichi is obligated to pay us ongoing research support and may become obligated to pay us certain other milestones payments. In addition, we are entitled to receive royalties on any commercialized products to emerge from the collaboration.

Johnson & Johnson

Effective December 1998, we entered into a three-year research collaboration with Janssen Pharmaceutica N.V., a division of Johnson & Johnson, which was extended through December 2003, to identify, discover and validate novel drug targets that regulate cell cycle, and, specifically, to identify drug targets and the active peptides that bind to them that can restore a mutated cell's ability to stop uncontrolled cell division. Under the agreement, we provided certain assays and associated technology to Johnson & Johnson for the assessment of the alteration or normalization of the dysfunctional cell cycles of cancer cells for Johnson & Johnson's internal research purposes. We entered into an amendment in July 2000, which expanded the collaboration by having us perform compound screening and medicinal chemistry on some of the validated targets accepted by Johnson & Johnson. We have identified several novel drug targets in this program, nine of which have been accepted by Johnson & Johnson as validated. Two of these nine targets have completed high-throughput screening, or HTS, at our facilities. Johnson & Johnson continues to be obligated to pay us various milestones and royalties if certain conditions are met.

Merck

In November 2004, we entered into a broad collaboration agreement with Merck to investigate ubiquitin ligases, a new class of drug target, to find treatments for cancer and potentially other diseases. Under the terms of the agreement, we received an initial cash payment and will receive funding for our research scientists for two and a half years, at which point the research phase of this collaboration will terminate. The collaboration is based on a number of new targets designated by

7

Merck and do not include our current ligase targets. In addition, we may nominate our own targets for potential inclusion in the collaboration. Merck is responsible for worldwide development and commercialization of any resulting compounds and will pay us royalties on future product sales, if any. Under this collaboration, if certain conditions are met, we are eligible to receive milestone payments for preclinical and clinical events.

Novartis

In May 1999, we entered into an agreement for the establishment of a broad collaboration with Novartis. We agreed to work with Novartis on up to five different five-year research projects to identify drug targets for products that can treat, prevent or diagnose the effects of human disease. Two of the research projects were conducted jointly by Novartis and us, and the other three research projects were to be conducted at Novartis. The first research project, a joint research project, focused on identifying small molecule drug targets that regulate T cells in the area of transplant rejection. The second research project, also a joint research project, related to the identification and validation of small molecule drug targets that mediate specific functions of B cells in the area of autoimmunity. Pursuant to the collaboration agreement, Novartis had the option to end the research phase on these programs after either 24 months or 42 months. In May 2002, Novartis elected to conclude the research phases of our two initial joint projects in the autoimmunity and transplant rejection areas after 42 months each, effective in November 2002 and February 2003, respectively. The third research project, a project currently being carried out at Novartis, is focused on identifying small molecule drug targets that regulate chronic bronchitis. Novartis may terminate this chronic bronchitis research at any time. In July 2001, we amended the agreement to add a three-year joint project at our facilities in the area of angiogenesis in lieu of one of the projects that were to be conducted at Novartis. As a result of this amendment, Novartis provided funding for research that was conducted at our facilities and made an additional upfront payment. In January 2002, Novartis chose not to exercise its option to add a final project that was to be conducted at Novartis. Novartis continues to be obligated to pay us various milestones and royalties if certain conditions are met.

Pfizer

Effective January 1999, we entered into a research collaboration with Pfizer to identify and validate intracellular drug targets that control and inhibit the production of IgE in B-cells in the area of asthma/allergy. The research phase of the collaboration was initially scheduled to end on January 31, 2001. In January 2001, Pfizer notified us of its election to exercise its option to extend the funded research portion of the collaboration one additional year to January 31, 2002. During the research phase, the collaboration was successful in identifying several intracellular drug targets that control the production of IgE, a key mediator in allergic reactions and asthma in B-cells. Through the conclusion of the research phase of the collaboration, which was extended by one additional month to February 28, 2002, Pfizer accepted a total of seven validated targets. Pfizer continues to be obligated to pay us various milestones and royalties if certain conditions are met.

In January 2005, we entered into a second research collaboration with Pfizer that has a license component. The collaboration is for the development of inhaled products for the treatment of allergic asthma and other respiratory diseases such COPD. The collaboration is focused on our preclinical small molecule compounds, which inhibit IgE receptor signaling in respiratory tract mast cells by blocking the signaling enzyme Syk kinase. The Syk kinase intrapulmonary collaboration with Pfizer does not include R112 our lead Syk kinase inhibitor that is being developed for the treatment of allergic rhinitis or the right to develop any of our Syk inhibitors in the field of allergic rhinitis. In August 2004, we completed a successful Phase II clinical study with R112 and are proceeding with the further clinical development of R112 for allergic rhinitis. Under certain conditions, Pfizer has a limited option to negotiate a license to R112 and our Syk inhibitors in the allergic rhinitis field under different financial and other terms

8

and conditions than are provided for in the current collaboration. Pursuant to the terms of the current collaboration, we received an upfront cash payment, and are eligible to receive milestone payments and royalties on any future product sales. Pfizer made an equity investment in Rigel at a premium and will be responsible for the worldwide development and commercialization of any resulting products.

Our Discovery Engine

The technologies that we use in connection with both our proprietary product development programs and our corporate collaborations are designed to identify protein targets for compound screening and validate the role of those targets in the disease process. Unlike genomics-based approaches, which begin by identifying genes and then search for their functions, our approach identifies proteins that are demonstrated to have an important role in a disease pathway. By understanding the disease pathway, we attempt to avoid studying genes that will not make good drug targets and focus only on the sub set of expressed proteins of genes that we believe are specifically implicated in the disease process.

We begin by developing assays that model the key events in a disease process at the cellular level. We then efficiently search hundreds of millions of cells to identify potential protein targets. In addition, we identify the proteins involved in the intracellular process and prepare a map of their interactions, thus giving us a comprehensive picture of the intracellular disease pathway. We believe that our approach has a number of advantages, including:

Because of the very large number of cells and proteins employed, our technology is labor intensive. The complexity of our technology requires a high degree of skill and diligence to perform successfully. In addition, successful application of our technology depends on a highly diverse collection of proteins to test in cells. We believe we have been able to and will continue to meet these challenges successfully and increase our ability to identify targets for drug discovery. Although other companies may utilize technologies similar to certain aspects of our technology, we are unaware of any other company that employs the same combination of technologies as we do.

Pharmacology and Preclinical Development

We believe that the rapid characterization and optimization of lead compounds identified in HTS will generate high-quality preclinical development candidates. Our pharmacology and preclinical

9

development group facilitates lead optimization by characterizing lead compounds with respect to pharmacokinetics, potency, efficacy and selectivity. The generation of proof-of-principle data in animals and the establishment of standard pharmacological models with which to assess lead compounds represent integral components of lead optimization. As programs move through the lead optimization stage, our pharmacology and preclinical development group supports our chemists and biologists by performing the necessary studies, including toxicology, for investigational new drug, or IND application submissions.

Clinical Development

We have assembled a team of experts in drug development to design and implement clinical trials and to analyze the data derived from these studies. The clinical development group possesses expertise in project management and regulatory affairs.

Research and Development Expenses

Our research and development expenses were $48.5 million in 2004, $41.6 million in 2003 and $40.8 million in 2002.

Intellectual Property

We are able to protect our technology from unauthorized use by third parties only to the extent that it is covered by valid and enforceable patents or is effectively maintained as a trade secret. Accordingly, patents or other proprietary rights are an essential element of our business. We have over 150 pending patent applications and over 50 issued patents in the United States that are owned by or exclusively licensed to us in our field as well as pending corresponding foreign patent applications. Our policy is to file patent applications to protect technology, inventions and improvements to inventions that are commercially important to the development of our business. We seek United States and international patent protection for a variety of technologies, including new screening methodologies and other research tools, target molecules that are associated with disease states identified in our screens, and lead compounds that can affect disease pathways. We also intend to seek patent protection or rely upon trade secret rights to protect other technologies that may be used to discover and validate targets and that may be used to identify and develop novel drugs. We seek protection, in part, through confidentiality and proprietary information agreements. We are a party to various license agreements that give us rights to use technologies in our research and development.

Competition

We face, and will continue to face, intense competition from pharmaceutical and biotechnology companies, as well as from academic and research institutions and government agencies, both in the United States and abroad. Some of these competitors are pursuing the development of pharmaceuticals that target the same diseases and conditions as our research programs. Our major competitors include fully integrated pharmaceutical companies that have extensive drug discovery efforts and are developing novel small molecule pharmaceuticals. We also face significant competition from organizations that are pursuing the same or similar technologies, including the discovery of targets that are useful in compound screening, as the technologies used by us in our drug discovery efforts. Our competitors or their collaborative partners may utilize discovery technologies and techniques or partner more rapidly or successfully than we or our collaborators are able to do.

Many of these companies and institutions, either alone or together with their collaborative partners, have substantially greater financial resources and larger research and development staffs than

10

we do. In addition, many of these competitors, either alone or together with their collaborative partners, have significantly greater experience than we do in:

Accordingly, our competitors may succeed in obtaining patent protection, identifying or validating new targets or discovering new drug compounds before we do.

Competition may also arise from:

Developments by others may render our product candidates or technologies obsolete or noncompetitive. We face and will continue to face intense competition from other companies for collaborative arrangements with pharmaceutical and biotechnology companies, for establishing relationships with academic and research institutions and for licenses to additional technologies. These competitors, either alone or with their collaborative partners, may succeed in developing technologies or products that are more effective than ours.

Our ability to compete successfully will depend, in part, on our ability to:

Government Regulation

Our ongoing development activities are and will be subject to extensive regulation by numerous governmental authorities in the United States and other countries, including the Food and Drug Administration, or FDA under the Federal Food, Drug and Cosmetic Act. The regulatory review and approval process is expensive and uncertain. Securing FDA approval requires the submission of extensive preclinical and clinical data and supporting information to the FDA for each indication to establish a product candidate's safety and efficacy. The approval process takes many years, requires the expenditure of substantial resources and may involve ongoing requirements for post-marketing studies. Clinical trials are subject to oversight by institutional review boards and the FDA and:

11

Even if we are able to achieve success in our clinical testing, we, or our collaborative partners, must provide the FDA and foreign regulatory authorities with clinical data that demonstrates the safety and efficacy of our products in humans before they can be approved for commercial sale. We also do not know whether any future clinical trials will demonstrate sufficient safety and efficacy necessary to obtain the requisite regulatory approvals or will result in marketable products. Our failure, or the failure of our strategic partners, to adequately demonstrate the safety and efficacy of our products under development will prevent receipt of FDA and similar foreign regulatory approval and, ultimately, commercialization of our products.

Any clinical trial may fail to produce results satisfactory to the FDA. Preclinical and clinical data can be interpreted in different ways, which could delay, limit or prevent regulatory approval. Negative or inconclusive results or adverse medical events during a clinical trial could cause a clinical trial to be repeated or a program to be terminated. In addition, delays or rejections may be encountered based upon additional government regulation from future legislation or administrative action or changes in FDA policy or interpretation during the period of product development, clinical trials and FDA regulatory review. Failure to comply with applicable FDA or other applicable regulatory requirements may result in criminal prosecution, civil penalties, recall or seizure of products, total or partial suspension of production or injunction, as well as other regulatory action against our potential products, collaborative partners or us. Additionally, we have no experience in working with our partners in conducting and managing the clinical trials necessary to obtain regulatory approval.

Outside the United States, our ability to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. The requirements governing the conduct of clinical trials, marketing authorization, pricing and reimbursement vary widely from country to country. At present, foreign marketing authorizations are applied for at a national level, although within the European Union, or EU, registration procedures are available to companies wishing to market a product in more than one EU member state. If the regulatory authority is satisfied that adequate evidence of safety, quality and efficacy has been presented, a marketing authorization will be granted. This foreign regulatory approval process involves all of the risks associated with FDA clearance.

Employees

As of December 31, 2004, we had 144 employees.

Scientific & Medical Advisors

We utilize scientists and physicians to advise us on scientific and medical matters as part of our ongoing research and product development efforts, including experts in clinical trial design, preclinical development work, chemistry, biology, infectious diseases, immunology and oncology. Certain of our scientific and medical advisors and consultants receive an option to purchase our common stock and an honorarium for time spent assisting us.

12

Available Information

We maintain a site on the world wide web at www.rigel.com. The information found on our website is not incorporated by reference into this annual report on Form 10-K. We electronically file with the Securities and Exchange Commission our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, our director and officers' Section 16 reports, other SEC filings and amendments to the reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. We make available free of charge on or through our website copies of these reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or SEC. Further, a copy of these reports is located at the Securities and Exchange Commission's Public Reference Room at 450 Fifth Street, NW, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov.

Risk Factors

In evaluating our business, you should carefully consider the following risks, as well as the other information contained in this annual report on Form 10-K. If any of the following risks actually occurs, our business could be harmed. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business.

We will need additional capital in the future to sufficiently fund our operations and research.

We have consumed substantial amounts of capital to date, and operating expenditures are expected to increase over the next several years. We believe that our existing capital resources and anticipated proceeds from current collaborations will be sufficient to support our current operating plan through at least the next twelve months. Our operations will require significant additional funding in large part due to our research and development expenses, future preclinical and clinical-testing costs, and the absence of any meaningful revenues for the foreseeable future. The amount of future funds needed will depend largely on the timing and structure of potential future collaborations. We do not know whether additional financing will be available when needed, or that, if available, we will obtain financing on terms favorable to our stockholders or us. We have consumed substantial amounts of capital to date, and operating expenditures are expected to increase over the next several years as we expand our infrastructure and research and development activities.

To the extent we raise additional capital by issuing equity securities, our stockholders would at that time experience substantial dilution. To the extent that we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish some rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us.

Our future funding requirements will depend on many uncertain factors.

Our future funding requirements will depend upon many factors, including, but not limited to:

13

Insufficient funds may require us to delay, scale back or eliminate some or all of our research or development programs, to lose rights under existing licenses or to relinquish greater or all rights to product candidates at an earlier stage of development or on less favorable terms than we would otherwise choose or may adversely affect our ability to operate as a going concern.

Our success as a company is uncertain due to our history of operating losses and the uncertainty of future profitability.

Due in large part to the significant research and development expenditures required to identify and validate new product candidates and pursue our development efforts, we have not been profitable and have incurred operating losses since we were incorporated in June 1996. The extent of our future losses and the timing of potential profitability are highly uncertain, and we may never achieve profitable operations. We incurred net losses of $56.3 million in 2004, $41.2 million in 2003, and $37.0 million in 2002. Currently, our revenues are generated solely from research payments pursuant to our collaboration agreements and licenses and are insufficient to generate profitable operations. As of December 31, 2004, we had an accumulated deficit of approximately $212.3 million. We expect to incur losses for at least the next several years and expect that these losses could increase as we expand our research and development activities and incur significant clinical and testing costs.

There is a high risk that early-stage drug discovery and development might not successfully generate good product candidates.

At the present time, the majority of our operations are in the early stages of drug identification and development. To date, three of our product compounds have made it to the clinical testing stage. In our industry, it is statistically unlikely that the limited number of compounds that we have identified as potential product candidates will actually lead to successful product development efforts, and we do not expect any drugs resulting from our research to be commercially available for several years, if at all. Our product compounds in the clinic and our future leads for potential drug compounds are subject to the risks and failures inherent in the development of pharmaceutical products based on new technologies. These risks include, but are not limited to, the inherent difficulty in selecting the right drug target and avoiding unwanted side effects as well as unanticipated problems relating to product development, testing, regulatory compliance, manufacturing, marketing, competition and costs and expenses that may exceed current estimates. The results of preliminary studies do not necessarily predict clinical or commercial success, and larger later-stage clinical trials may fail to confirm the results observed in the preliminary studies. With respect to our own compounds in development, we have established anticipated timelines for clinical development based on existing knowledge of the

14

compound. However, we cannot provide assurance that we will meet any of these timelines with respect to the initiation or completion of clinical studies.

We have also commenced clinical trials of R406 in December 2004 and expect to initiate clinical trials of R763 in the second half of 2005. Because of the uncertainty of whether the accumulated preclinical evidence (pharmacokinetic, pharmacodynamic, safety and/or other factors) or early clinical results will be observed in later clinical trials, we can make no assurance regarding the likely results from our future clinical trials or the impact of those results on our business.

We might not be able to commercialize our product candidates successfully if problems arise in the clinical testing and approval process.

Commercialization of our product candidates depends upon successful completion of preclinical studies and clinical trials. Preclinical testing and clinical development are long, expensive and uncertain processes. We do not know whether we, or any of our collaborative partners, will be permitted to undertake clinical trials of potential products beyond the trials already concluded and the trials currently in process. It may take us or our collaborative partners several years to complete any such testing, and failure can occur at any stage of testing. Interim results of trials do not necessarily predict final results, and acceptable results in early trials may not be repeated in later trials. A number of companies in the pharmaceutical industry, including biotechnology companies, have suffered significant setbacks in advanced clinical trials, even after achieving promising results in earlier trials. Moreover, as our projects reach clinical trials, we or our collaborative partners or regulators may decide to discontinue development of any or all of these projects at any time for commercial, scientific or other reasons. For example, if patients experience undesirable side effects, we may be required to halt or suspend a clinical trial.

Delays in clinical testing could result in increased costs to us.

Significant delays in clinical testing could materially impact our product development costs. We do not know whether planned clinical trials will begin on time, will need to be revamped or will be completed on schedule, or at all. Clinical trials can be delayed for a variety of reasons, including delays in obtaining regulatory approval to commence a study, delays in reaching agreement on acceptable clinical study agreement terms with prospective clinical sites, delays in obtaining institutional review board approval to conduct a study at a prospective clinical site or delays in recruiting subjects to participate in a study. Environmental conditions may impact the execution of some clinical trials, particularly in the allergy area.

In addition, we typically rely on third-party clinical investigators to conduct our clinical trials and other third-party organizations to oversee the operations of such trials and to perform data collection and analysis. As a result, we may face additional delaying factors outside our control if these parties do not perform their obligations in a timely fashion. While we have not yet experienced delays that have materially impacted our clinical trials or product development costs, delays of this sort could occur for the reasons identified above or other reasons. If we have delays in testing or approvals, our product development costs will increase. For example, we may need to make additional payments to third-party investigators and organizations to retain their services or we may need to pay recruitment incentives. If the delays are significant, our financial results and the commercial prospects for our product candidates will be harmed, and our ability to become profitable will be delayed.

15

We lack the capability to manufacture compounds for development and rely on third parties to manufacture our product candidates, and we may be unable to obtain required material in a timely manner, at an acceptable cost or at a quality level required to receive regulatory approval.

We currently do not have manufacturing capabilities or experience necessary to produce materials, including R112, R406, and R763 for preclinical testing and clinical trials. We rely on a single third-party contractor to produce R112 and R406 bulk drug substance. We also rely on different single manufacturers for finished R112 and R406 product for preclinical and clinical testing. We will rely on manufacturers to deliver materials on a timely basis and to comply with applicable regulatory requirements, including the FDA's current Good Manufacturing Practices, or GMP. These outsourcing efforts with respect to manufacturing preclinical and clinical supplies will result in a dependence on our suppliers to timely manufacture and deliver sufficient quantities of materials produced under GMP conditions to enable us to conduct planned preclinical studies, clinical trials and, if possible, to bring products to market in a timely manner.

Our current and anticipated future dependence upon these third-party manufacturers may adversely affect our ability to develop and commercialize product candidates on a timely and competitive basis. These manufacturers may not be able to produce material on a timely basis or manufacture material at the quality level or in the quantity required to meet our development timelines and applicable regulatory requirements. We may not be able to maintain or renew our existing third-party manufacturing arrangements, or enter into new arrangements, on acceptable terms, or at all. Our third-party manufacturers could terminate or decline to renew our manufacturing arrangements based on their own business priorities, at a time that is costly or inconvenient for us. If we are unable to contract for the production of materials in sufficient quantity and of sufficient quality on acceptable terms, our planned clinical trials may be delayed. Delays in preclinical or clinical testing could delay the filing of our IND applications and/or the initiation of clinical trials that we have currently planned.

Our third-party manufacturers may not be able to comply with the GMP regulations, other applicable FDA regulatory requirements or similar regulations applicable outside of the United States. Additionally, if we are required to enter into new supply arrangements, we may not be able to obtain approval from the FDA of any alternate supplier in a timely manner, or at all, which could delay or prevent the clinical development and commercialization of any related product candidates. Failure of our third-party manufacturers or us to obtain approval from the FDA or to comply with applicable regulations could result in sanctions being imposed on us, including fines, civil penalties, delays in or failure to grant marketing approval of our product candidates, injunctions, delays, suspension or withdrawal of approvals, license revocation, seizures or recalls of products and compounds, operating restrictions and criminal prosecutions, any of which could significantly and adversely affect our business.

Because most of our expected future cash proceeds are contingent upon collaborative and license agreements, we might not meet our strategic objectives.

Our ability to generate cash proceeds in the near term depends on our ability to enter into additional collaborative agreements with third parties and to maintain the agreements we currently have in place. Our ability to enter into new collaborations and the cash proceeds, if any, that may be earned under these collaborations is highly uncertain. If we are unable to enter into new collaborations, our business prospects could be harmed, which could have an immediate adverse effect on the trading price of our stock.

To date, most of our cash proceeds have been related to the research phase of each of our collaborative agreements. Such cash proceeds are for specified periods, and the impact of such cash procceds on our results of operations is partially offset by corresponding research costs. Following the completion of the research phase of each collaborative agreement, additional cash proceeds may come only from milestone payments and royalties, which may not be paid, if at all, until some time well into

16

the future. The risk is heightened due to the fact that unsuccessful research efforts may preclude us from receiving any milestone payments under these agreements. Our receipt of cash proceeds from collaborative arrangements is also significantly affected by the timing of efforts expended by us and our collaborators and the timing of lead compound identification. In late 2001, we earned the first cash proceed from achievement of milestones in both the Pfizer and Johnson & Johnson collaborations. During 2002, we earned our first milestone for both Novartis and Daiichi. Under many agreements, however, milestone payments may not be earned until the collaborator has advanced products into clinical testing, which may never occur or may not occur until some time well into the future. If we are not able to generate cash proceeds under our collaborations when and in accordance with our expectations or the expectations of industry analysts, this failure could harm our business and have an immediate adverse effect on the trading price of our stock.

Our business requires us to generate meaningful cash proceeds from royalties and licensing agreements. To date, we have not received any cash proceeds from royalties for the commercial sale of drugs, and we do not know when we will receive any such cash proceeds, if at all. Likewise, we have not licensed any lead compounds or drug development candidates to third parties, and we do not know whether any such license will be entered into on acceptable terms in the future, if at all.

If our current corporate collaborations or license agreements are unsuccessful, our research and development efforts could be delayed.

Our strategy depends upon the formation and sustainability of multiple collaborative arrangements and license agreements with third parties in the future. We rely on these arrangements for not only financial resources, but also for expertise that we expect to need in the future relating to clinical trials, manufacturing, sales and marketing, and for licenses to technology rights. To date, we have entered into several such arrangements with corporate collaborators; however, we do not know if such third parties will dedicate sufficient resources or if any development or commercialization efforts by third parties will be successful. Should a collaborative partner fail to develop or commercialize a compound or product to which it has rights from us, such failure might delay ongoing research and development efforts at Rigel because we might not receive any future milestone payments and we would not receive any royalties associated with such compound or product. In addition, the continuation of some of our partnered drug discovery and development programs may be dependent on the periodic renewal of our corporate collaborations.

The research phase of our collaboration with Johnson & Johnson ended in December 2003 and the research phases conducted at our facilities under our broad collaboration with Novartis ended in July 2004. The research phase of our corporate collaboration agreement with Daiichi will end in August 2005. In November 2004 we signed a new corporate collaboration with Merck and in January 2005 we signed an additional collaboration with Pfizer. We may not be able to renew these collaborations on acceptable terms, if at all, or negotiate additional corporate collaborations on acceptable terms, if at all.

Conflicts also might arise with collaborative partners concerning proprietary rights to particular compounds. While our existing collaborative agreements typically provide that we retain milestone payments and royalty rights with respect to drugs developed from certain derivative compounds, any such payments or royalty rights may be at reduced rates, and disputes may arise over the application of derivative payment provisions to such drugs, and we may not be successful in such disputes.

We are also a party to various license agreements that give us rights to use specified technologies in our research and development processes. The agreements pursuant to which we have in-licensed technology permit our licensors to terminate the agreements under certain circumstances. If we are not able to continue to license these and future technologies on commercially reasonable terms, our product development and research may be delayed.

17

If conflicts arise between our collaborators or advisors and us, any of them may act in their self-interest, which may be adverse to our stockholders' interests.

If conflicts arise between us and our corporate collaborators or scientific advisors, the other party may act in its self-interest and not in the interest of our stockholders. Some of our corporate collaborators are conducting multiple product development efforts within each disease area that is the subject of the collaboration with us. In some of our collaborations, we have agreed not to conduct, independently or with any third party, any research that is competitive with the research conducted under our collaborations. Our collaborators, however, may develop, either alone or with others, products in related fields that are competitive with the products or potential products that are the subject of these collaborations. Competing products, either developed by our collaborators or to which our collaborators have rights, may result in their withdrawal of support for our product candidates.

If any of our corporate collaborators were to breach or terminate its agreement with us or otherwise fail to conduct the collaborative activities successfully and in a timely manner, the preclinical or clinical development or commercialization of the affected product candidates or research programs could be delayed or terminated. We generally do not control the amount and timing of resources that our corporate collaborators devote to our programs or potential products. We do not know whether current or future collaborative partners, if any, might pursue alternative technologies or develop alternative products either on their own or in collaboration with others, including our competitors, as a means for developing treatments for the diseases targeted by collaborative arrangements with us.

Our success is dependent on intellectual property rights held by us and third parties, and our interest in such rights is complex and uncertain.

Our success will depend to a large part on our own, our licensees' and our licensors' ability to obtain and defend patents for each party's respective technologies and the compounds and other products, if any, resulting from the application of such technologies. We have over 150 pending patent applications and over 50 issued patents in the United States that are owned or exclusively licensed in our field as well as pending corresponding foreign patent applications. In the future, our patent position might be highly uncertain and involve complex legal and factual questions. Additional uncertainty may result from because no consistent policy regarding the breadth of legal claims allowed in biotechnology patents has emerged to date. Accordingly, we cannot predict the breadth of claims allowed in our or other companies' patents.

Because the degree of future protection for our proprietary rights is uncertain, we cannot ensure that:

We rely on trade secrets to protect technology where we believe patent protection is not appropriate or obtainable. However, trade secrets are difficult to protect. While we require employees,

18

collaborators and consultants to enter into confidentiality agreements, we may not be able to adequately protect our trade secrets or other proprietary information in the event of any unauthorized use or disclosure or the lawful development by others of such information.

We are a party to certain in-license agreements that are important to our business, and we generally do not control the prosecution of in-licensed technology. Accordingly, we are unable to exercise the same degree of control over this intellectual property as we exercise over our internally-developed technology. Moreover, some of our academic institution licensors, research collaborators and scientific advisors have rights to publish data and information in which we have rights. If we cannot maintain the confidentiality of our technology and other confidential information in connection with our collaborations, then our ability to receive patent protection or protect our proprietary information will be impaired. In addition, some of the technology we have licensed relies on patented inventions developed using U.S. government resources. The U.S. government retains certain rights, as defined by law, in such patents, and may choose to exercise such rights. Certain of our in-licenses may be terminated if we fail to meet specified obligations. If we fail to meet such obligations and any of our licensors exercise their termination rights, we could lose our rights under those agreements. If we lose any of our rights, it may affect the way we do business. In addition, because certain of our licenses are sublicenses, the actions of our licensors may affect our rights under those licenses.

If a dispute arises regarding the infringement or misappropriation of the proprietary rights of others, such dispute could be costly and result in delays in our research and development activities and partnering.

Our success will also depend, in part, on our ability to operate without infringing or misappropriating the proprietary rights of others. There are many issued patents and patent applications filed by third parties relating to products or processes that are similar or identical to ours or our licensors, and others may be filed in the future. There can be no assurance that our activities, or those of our licensors, will not infringe patents owned by others. For example, in June 2002, we resolved a dispute with Inoxell A/S (formed as a spinout from Pharmexa—formally M&E Biotech) by entering into a global patent settlement concerning certain drug target identification technologies, which includes both cross-licensing and joint ownership with respect to certain patents and allows for worldwide freedom of operation for both companies. We believe that there may be significant litigation in the industry regarding patent and other intellectual property rights, and we do not know if we or our collaborators would be successful in any such litigation. Any legal action against our collaborators or us claiming damages or seeking to enjoin commercial activities relating to the affected products, our methods or processes could:

If we are unable to obtain regulatory approval to market products in the United States and foreign jurisdictions, we might not be permitted to commercialize products from our research and development.

Due, in part, to the early stage of our product candidate research and development process, we cannot predict whether regulatory clearance will be obtained for any product that we, or our

19

collaborative partners, hope to develop. Satisfaction of regulatory requirements typically takes many years, is dependent upon the type, complexity and novelty of the product and requires the expenditure of substantial resources. Of particular significance to us are the requirements relating to research and development and testing.

Before commencing clinical trials in humans in the United States, we, or our collaborative partners, will need to submit and receive approval from the FDA of an IND. Clinical trials are subject to oversight by institutional review boards and the FDA and:

While we have stated that we intend to file additional INDs, this is only a statement of intent, and we may not be able to do so because we may not be able to identify potential product candidates. In addition, the FDA may not approve any IND in a timely manner, or at all.

Before receiving FDA clearance to market a product, we must demonstrate that the product is safe and effective on the patient population that will be treated. Data obtained from preclinical and clinical activities are susceptible to varying interpretations that could delay, limit or prevent regulatory clearances. In addition, delays or rejections may be encountered based upon additional government regulation from future legislation or administrative action or changes in FDA policy during the period of product development, clinical trials and FDA regulatory review. Failure to comply with applicable FDA or other applicable regulatory requirements may result in criminal prosecution, civil penalties, recall or seizure of products, total or partial suspension of production or injunction, as well as other regulatory action against our potential products or us. Additionally, we have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approval.

If regulatory clearance of a product is granted, this clearance will be limited to those disease states and conditions for which the product is demonstrated through clinical trials to be safe and efficacious. We cannot ensure that any compound developed by us, alone or with others, will prove to be safe and efficacious in clinical trials and will meet all of the applicable regulatory requirements needed to receive marketing clearance.

Outside the United States, our ability, or that of our collaborative partners, to market a product is contingent upon receiving a marketing authorization from the appropriate regulatory authorities. This foreign regulatory approval process typically includes all of the risks associated with FDA clearance described above and may also include additional risks.

If our competitors develop technologies that are more effective than ours, our commercial opportunity will be reduced or eliminated.

The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. Many of the drugs that we are attempting to discover will be competing with existing therapies. In addition, a number of companies are pursuing the development of

20

pharmaceuticals that target the same diseases and conditions that we are targeting. We face competition from pharmaceutical and biotechnology companies both in the United States and abroad.

Our competitors may utilize discovery technologies and techniques or partner with collaborators in order to develop products more rapidly or successfully than we, or our collaborators, are able to do. Many of our competitors, particularly large pharmaceutical companies, have substantially greater financial, technical and human resources than we do. In addition, academic institutions, government agencies and other public and private organizations conducting research may seek patent protection with respect to potentially competitive products or technologies and may establish exclusive collaborative or licensing relationships with our competitors.

We believe that our ability to compete is dependent, in part, upon our ability to create, maintain and license scientifically-advanced technology and upon our and our collaborators' ability to develop and commercialize pharmaceutical products based on this technology, as well as our ability to attract and retain qualified personnel, obtain patent protection or otherwise develop proprietary technology or processes and secure sufficient capital resources for the expected substantial time period between technological conception and commercial sales of products based upon our technology. The failure by us or any of our collaborators in any of those areas may prevent the successful commercialization of our potential drug targets.

Our competitors might develop technologies and drugs that are more effective or less costly than any that are being developed by us or that would render our technology and potential drugs obsolete and noncompetitive. In addition, our competitors may succeed in obtaining the approval of the FDA or other regulatory agencies for product candidates more rapidly. Companies that complete clinical trials, obtain required regulatory agency approvals and commence commercial sale of their drugs before their competitors may achieve a significant competitive advantage, including certain patent and FDA marketing exclusivity rights that would delay or prevent our ability to market certain products. Any drugs resulting from our research and development efforts, or from our joint efforts with our existing or future collaborative partners, might not be able to compete successfully with competitors' existing or future products or obtain regulatory approval in the United States or elsewhere.

Our ability to generate revenues will be diminished if our collaborative partners fail to obtain acceptable prices or an adequate level of reimbursement for products from third-party payors or government agencies.

The drugs we hope to develop may be rejected by the marketplace due to many factors, including cost. Our ability to commercially exploit a drug may be limited due to the continuing efforts of government and third-party payors to contain or reduce the costs of health care through various means. For example, in some foreign markets, pricing and profitability of prescription pharmaceuticals are subject to government control. In the United States, we expect that there will continue to be a number of federal and state proposals to implement similar government control. In addition, increasing emphasis on managed care in the United States will likely continue to put pressure on the pricing of pharmaceutical products. Cost control initiatives could decrease the price that any of our collaborators would receive for any products in the future. Further, cost control initiatives could adversely affect our collaborators' ability to commercialize our products and our ability to realize royalties from this commercialization.

Our ability to commercialize pharmaceutical products with collaborators may depend, in part, on the extent to which reimbursement for the products will be available from:

21

Significant uncertainty exists as to the reimbursement status of newly-approved healthcare products. Third-party payors, including Medicare, are challenging the prices charged for medical products and services. Government and other third-party payors increasingly are attempting to contain healthcare costs by limiting both coverage and the level of reimbursement for new drugs and by refusing, in some cases, to provide coverage for uses of approved products for disease indications for which the FDA has not granted labeling approval. Third-party insurance coverage may not be available to patients for any products we discover and develop, alone or with collaborators. If government and other third-party payors do not provide adequate coverage and reimbursement levels for our products, the market acceptance of these products may be reduced.

If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit commercialization of our products.

The testing and marketing of medical products entail an inherent risk of product liability. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our products although we are not currently aware of any specific causes for concern with respect to clinical liability claims. We currently do not have product liability insurance, and our inability to obtain sufficient product liability insurance at an acceptable cost to protect against potential product liability claims could prevent or inhibit the commercialization of pharmaceutical products we develop, alone or with corporate collaborators. We, or our corporate collaborators, might not be able to obtain insurance at a reasonable cost, if at all. While under various circumstances we are entitled to be indemnified against losses by our corporate collaborators, indemnification may not be available or adequate should any claim arise.

Our research and development efforts will be seriously jeopardized, if we are unable to attract and retain key employees and relationships.

As a small company with only 144 employees as of December 31, 2004, our success depends on the continued contributions of our principal management and scientific personnel and on our ability to develop and maintain important relationships with leading academic institutions, scientists and companies in the face of intense competition for such personnel. In particular, our research programs depend on our ability to attract and retain highly skilled chemists, other scientists, and regulatory and clinical personnel. If we lose the services of any of our personnel, our research and development efforts could be seriously and adversely affected. Our employees can terminate their employment with us at any time.

We depend on various scientific consultants and advisors for the success and continuation of our research and development efforts.